China and Home Sales Fuel A Breakout – Look For Continuation This Week!

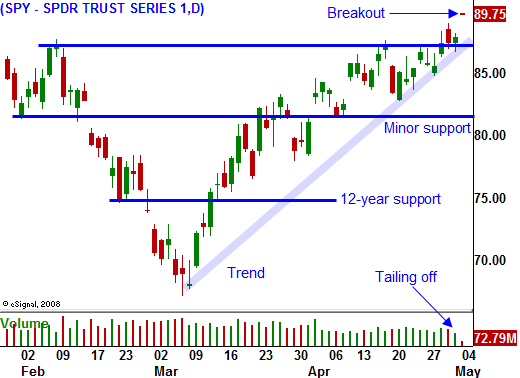

Once I saw the market’s reaction to the potential Swine Flu pandemic and the dismal GDP report last week, I knew we were heading higher. The market is likely to break through resistance at SPY 90 in the next day or two.

There are many influences pushing the market higher today. Beginning-of-the-month fund buying is adding to the rally as Asset Managers put money to work. Bullish news from China set a positive backdrop this morning. Their PMI rose to 50.1 and this is the first time in many months it has been over 50 (indicating economic growth). Chinese officials believe that Q2 growth will come in at 7%. Shanghai was up 3% and Hang Seng was up 5% on the news. We also had good news of our own and pending home sales rose 3.2% when economists had expected a "flat" number. Since we are about to break out, shorts are covering. The bulls have the ball and the upward momentum continues.

The government will have an influence on the market this week. In a few moments, Obama will outline his plan to tax corporate overseas profits. In essence, companies that reinvest foreign profits overseas will be taxed. This is deemed by his administration as a loop hole and it is not good news for corporations. Thursday, the government will release its "stress test". It is rumored that a number of banks will need additional capital. It’s rumored that BAC is trying to raise $10 billion to address the stress test findings. Citigroup, Wells Fargo and PNC financial are a few other banks that could need to raise additional capital. I doubt that the government is going to cast fear into our financial system and the evaluation will be fairly lenient.

The economic releases this week include ISM services, ADP employment index, initial jobless claims, productivity, consumer credit and the Unemployment Report. If any of the economic releases are outright bullish (like the pending home sales number today), the market will stage a nice rally. In the past few weeks, bulls have had to pick out the silver lining from an otherwise dismal number. If this changes and there are signs of improvement, the market could mount a sustained rally.

The Unemployment Report should still raise concerns and I expect it to climb. However, it has not generated a market selloff in over four months. The momentum clearly favors the bulls and we are likely to see this market climb higher this week.

This will also be a busy week for earnings. Almost 40% of the S&P 500 companies have reported and 69% of them have beat earnings estimates. Analysts greatly reduced their expectations and the bar has been set low. They were expecting earnings to drop 34% this quarter and they are expecting earnings to be down 33% in Q2. This means that companies should continue to exceed expectations this quarter and estimates are likely to be revised upwards.

Advancers outnumbered decliners by six to one and the market should continue to climb higher this afternoon. It will hit resistance at SPY 90 and 92, but it should be able to get to those levels this week. Commodity stocks are on fire and that is where I'm getting long. The news from China bodes well for this sector and the threat of inflation will also fuel these stocks.

The market is overbought and we are in a long-term bear market. This means you have to be careful trading this rally. Don't get too aggressive; don't chase stocks and take profits along the way.

Daily Bulletin Continues...