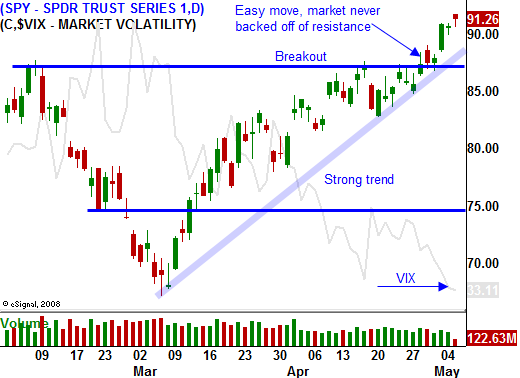

The Market Is Through Resistance and It Should Continue To Rally!

The market continues to move higher and it broke through resistance at SPY 90 with ease. Normally, you would see the market back off as it approaches a significant price point. The fact that it did not, tells me that buyers are aggressively coming into the market. Part of that is short covering and part of it is bona fide buying.

Last week, swine flu and a horrible GDP number could have spooked investors and it did not. Favorable economic news from China got things started Monday morning. Their PMI rose above 50 for the first time in months and they expect Q2 growth to exceed 7%. An increase in pending home sales added fuel to the move and we were off to the races Monday. This morning, new home purchases increased more than expected. Financing for home purchases outnumbered refinancing on existing loans for the first time in months.

The ADP employment index also exceeded estimates. In April, 491,000 jobs were lost compared to 708,000 jobs (revised downward from 742,000) in March. Unemployment is still on the rise, but at a slower pace. Challenger Gray & Christmas reported that planned layoffs declined 12% from 150,000 in March to 133,000 in April. If tomorrow's initial jobless claims number confirms this trend, we could see another rally ahead of Friday's Unemployment Report. This is the biggest piece of economic data released each month.

Tomorrow, the government will release the results of its "stress test". News related to the outcome keeps leaking out. This morning, Bank of America said that it will need to raise $35 billion. Much of that can be satisfied by converting the government's preferred shares into common shares. Ideally, they won't resort to that and they will try to raise private equity. Citigroup projects that the 19 banks in question will need to raise an aggregate $75 billion. They believe Wells Fargo will need to raise $22 billion. BAC and WFC comprise almost 80% of the capital required according to Citi’s estimates.

The market seems rather content with the transparency and it continues to move higher. Bears are scared and they are covering. I don't see any major pullbacks at this level and confidence is returning to the market.

Commodity stocks are on fire and interest rates are on the rise. I believe we will see this rally continue into the close and I am selling puts in commodity stocks. As the Fed purchases treasuries, the dollar will fall. They have disclosed their intentions and I see this as a certainty. As the dollar falls, commodity prices will rise.

Stay bullish, don't chase and take profits.

Daily Bulletin Continues...