Look For Weakness Next Week – Start Lining Up Your Shorts!

I am going to keep today's comments brief since there haven't been any major events overnight. Trading will slow down considerably heading into the holiday weekend.

Yesterday, we learned that England's credit rating was lowered. Their deficit has almost reached 100% of GDP (much higher than our debt level). This will greatly increase their cost of capital. Our budget deficit will hit $2 trillion this year, more than twice the level of the prior high 25 years ago. Massive debt levels and atrocious lending decisions will not be solved with more debt. Taxpayers and shareholders will pay for many years to come.

For the time being, a financial collapse has been averted. The cost to taxpayers has yet to be determined, but it will increase in coming months as interest rates jump. Countries around the world are issuing debt like mad and investors are demanding higher rates of return. Standard & Poor's fired a warning shot across the bow of the United States. It should be clear that the possibility of a credit rating downgrade is possible.

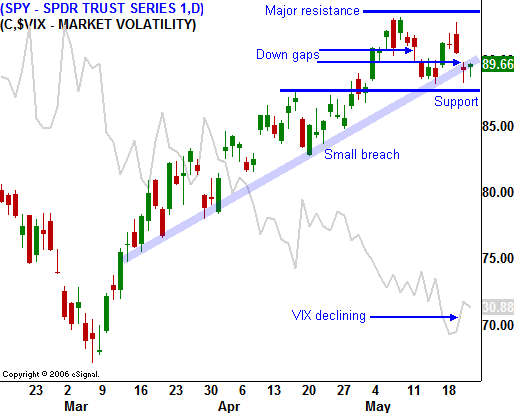

As I've been stating, all of the good news is baked into prices. The market does not have any "drivers" and in the last two weeks we've seen two down gaps near a major resistance level. We did get a bounce Monday on news that the Communist Party was handily defeated in India's elections. That pop was very short-lived and the market quickly pulled back.

Next week, there are many economic releases. The market has lost its momentum and bad news will once again have a negative impact. I believe the GDP report could weigh heavily on prices.

Traders do not want to go into the weekend short and that should keep us from seeing a major decline today. I am selling calls spreads and I am scaling into put positions. In this light trading environment, I am not placing any major bets. Keep your powder dry and look for shorting opportunities in retail, defense, utilities and REITs next week.

Daily Bulletin Continues...