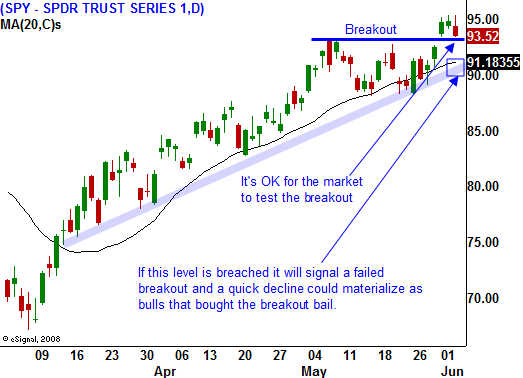

The Market Is Testing The Breakout – A Close Below SPY 93 Is Bearish!

Until today, the market has been able to hold onto the gains from Monday. Positive economic news from China and a better-than-expected instruction spending number pushed the market through major resistance at SPY 94.

This three-month rally has been based on an economic rebound in China, stabilization in the financial sector, a deceleration in the rate of economic deterioration and corporate earnings.

The news from China was good, but not great. There Purchasing Managers Index declined month over month and it is barely above 50 (economic expansion). I doubt that one country can pull the entire world out of this mess. Earlier in the week, South Korea and Japan both released very weak economic numbers. Europe and the United States are also in dire shape. The wealthiest areas of the world are not faring well. China was the first sign of hope back in March and commodity prices started to rise.

Next, banks stated that they would make money in Q1. That is spread quickly and financial stocks sparked the rally. Most successfully passed the stress test (which assumed an 8.9% unemployment rate) and those that did not have been able to raise capital. The new supply of stock has diluted shareholders and this sector will have a "lid" on it. Furthermore, FASB rule changes have allowed banks to sit on their toxic assets. This is clogging up reserves and banks are not lending.

Economic numbers are not plummeting at their prior rate, but the data is anything but positive. When we freefall to multi-decade lows in a manner of months, of course that pace can't be sustained. We would be at Ground Zero in a matter of months. The market has been able to rally on bad news, but that has run its course. Traders are seeing downward revisions in prior months and that is concerning. This morning, factory orders came in at .7% when .9% was expected. Last month's number was revised from a -.9% to -1.9%. The same trend of downward revisions can be seen across most economic releases. The ADP employment index showed that 532,000 jobs were lost last month. While that might be better than last month's number, it was revised from -491,000 to -545,000. We are still losing jobs and alarming rate and personally I see very little to get excited about.

Earnings came in strong and 70% of the S&P 500 beat expectations. Unfortunately, analysts had lowered their estimates and they expected earnings to be down 34% in Q1. Obviously, they overshot. There is a good chance that estimates will be raised ahead of Q2 since they were expecting profits to be down 34% in this quarter as well. To a large degree, good news has been factored into stock prices and the market has rallied 35% off of its low.

I was expecting resistance to hold and I was wrong. I'm trying to stay objective, but I just can't see where the underlying strength will come from. From a technical perspective, it's fine for the market to pull back and retest the breakout before it stages the next rally. However, if it closes below the breakout and it reaches the 20-day moving average and the uptrend line, things could get ugly. Bulls that came late to the party and bought the breakout will bail on positions and that will create selling pressure. That will also prompt profit-taking by those who have nice gains on long positions.

There wasn't really much news to topple the market today, and that downward price action has come easily. Decliners outnumber advancers by a 3 to 1 margin and a pullback before Friday's unemployment number seems likely. The ECB and the BOE (Bank of England) will also determine their interest-rate policy before tomorrow's open. I believe interest rates will be a key concern moving forward and we have two very large bond auctions next week.

For today, I expect downward price action. If the market closes below SPY 93, I will sell my long call positions and I will take my losses. The follow-through rally I was looking for does not look like it will materialize. If the action is particularly nasty heading into the bell, I am likely to buy a few puts on defense stocks, retailers and utilities. I misjudged this week's action and I am keeping my size small until I can get a better handle on the market.

Daily Bulletin Continues...