Use SPY 93 As Your Guide – If We Close Below It – Get Short!

Yesterday, the market was set up for a weak open after Europe traded lower. Eastern European countries are on the brink of financial collapse and they are weighing on the rest of the EU. All European countries are fighting their own individual battles and they are not willing to extend credit to Eastern European countries. Latvia had no bids for its T-bill auction and it is in dire shape.

This morning, the ECB said it expects a much sharper recession this year than earlier forecasted. The central bank's staff forecasts a 5.1% drop this year in economic activity and 2010 will be flat at best. It kept rates steady at 1%.

Wednesday's ADP employment index came in weaker than expected and April's number was revised to a much higher level of unemployment. Many of the initial economic numbers have been revised to show weaker conditions and that trend continues.

This morning, initial jobless claims showed a slight improvement and ONLY 621,000 Americans filed for unemployment benefits last week. I am being facetious because I am reading comments on how jobless claims have improved and it might be signaling a bottom. The focus seems to be on the fact that 4,000 fewer workers filed for benefits compared to the prior week. That still means 621,000 new applicants filed and I am not encouraged by the “improvement”. Continuing unemployment claims did drop slightly. It has concluded its 20-week rise to all-time highs.

Tomorrow's Unemployment Report will be weak, but the market has been able to shrug-off the actual number. I am also expecting last month's unemployment to be revised upward (meaning more people were unemployed than originally reported).

Retail sales came in weaker than expected and regardless of last week's consumer confidence numbers, people are not spending money. Reality has set in and the average baby boomer has less than $60,000 saved for retirement. I believe we will see a long-term shift from "shop till you drop" to "save to the grave".

As you know from my prior comments, I don't believe that one country (China) can pull the rest of the world out of an economic recession. The nations with the greatest wealth (United States, Japan, South Korea, England, Germany...) are all under economic distress. Debt and leverage are the problem and time and savings are the solution.

There is a good chance that the market will be able to recover from tomorrow's number and bulls are likely to find the silver lining. Traders do not want to be short heading into the weekend. The last five Mondays have been very bullish and we have seen big rallies. As next week unfolds, two very large bond auctions will be the focal point. Interest rates are on the rise and that will provide a stiff head wind for stocks. The Fed has already used 70% of its $300 billion budget to buy treasuries and it has not kept interest rates from rising.

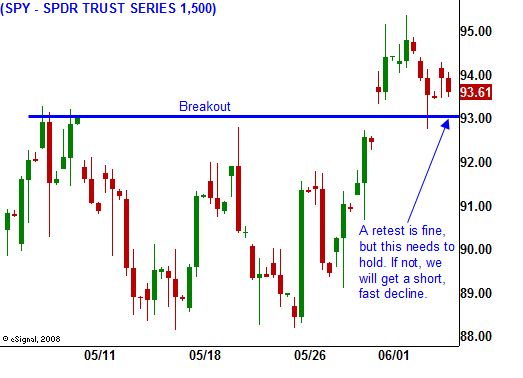

I did not expect Monday's market breakout, but it has not been able to follow through. I don't see any market "drivers" to push it higher, I do see potential issues (a financial collapse in Eastern Europe, higher interest rates, inflation). If the market can’t hold the breakout, we will see a sharp, swift decline. Bulls that recently jumped onto the bandwagon will be flushed out of the market.

If the market rally continues, I will sell out of the money put credit spreads on commodity stocks. The dollar is crumbling and that will lend support to this sector. If the market closes below SPY 93, I will buy puts on defense, retail and utility stocks. These groups have been relatively weak. For now, I will wait to see which side wins.

Daily Bulletin Continues...