Watch For Active Trading This Afternoon – Bond Auction and Beige Book!

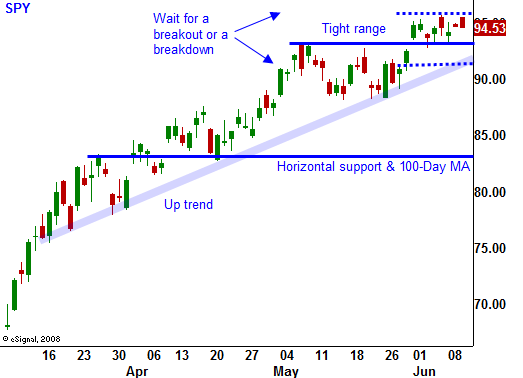

The market has fallen into a very tight trading range. There aren't any "drivers" in either direction and traders are waiting for a breakdown or a breakout.

This morning, mortgage applications declined 7% from the prior week and that is the biggest drop since November. Mortgage rates have climbed more than 1% in three weeks and that is weighing on homebuyers. Interest rates will play an important part in this week's trading.

Yesterday, the $35 billion three-year note auction went well and it was oversubscribed by a factor of 2.8. Yields dropped slightly and the market tried to rally on the news. The more important auctions take place today and tomorrow. This afternoon, $19 billion in 10-year notes will be auctioned and traders will be watching to see if the yield rises above 4%. If that happens, the market will sell off. Tomorrow, the Treasury will auction 30-year bonds. Short-term rates have started to climb and that is putting pressure on the Fed’s 0% policy.

I expect a quiet day ahead of the bond auction. Once that news is released, traders will act. This afternoon, the Fed will release the Beige Book. Both events are likely to result in active trading.

Tomorrow, retail sales and initial jobless claims will be released. Analysts are looking for retail sales to rise .5% and I feel that there is room for disappointment. The unemployment rate continues to climb and consumers are cautious. Initial jobless claims increased less than expected last week and there might be a slight improvement tomorrow. These two numbers are likely to negate one another and interest rates will be the focal point.

Traders will wait to see which way the market breaks from here. A tug-of-war has set in and bulls and bears are fighting it out. Once a winner has emerged, the market will make a sustained move in that direction. I feel that stocks have made a fantastic rebound, but deteriorating economic conditions don't support higher stock prices at this time. I will keep my powder dry, but I favor the downside. It doesn't make sense to place large bets when the market could move in either direction.

I will start scaling in to short positions on a close below SPY 93. Defense stocks are my favorite play. If the market rallies to a new relative high, I will sell out of the money put credit spreads on commodity stocks. I expect a quiet morning and an active afternoon.

Daily Bulletin Continues...