Scale In To Bearish Positions On Continued Market Weakness!

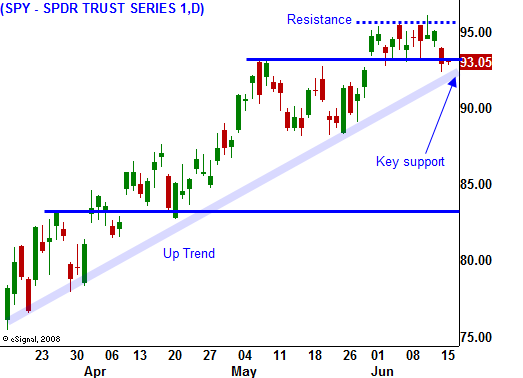

Yesterday, the market started off on a weak note and it did not stage one of its typical late day rebounds. We finished below key support at SPY 93 and the bears are close to a breakdown. If the market stages another decline today, the selling pressure will accelerate during option expiration.

There weren't any news events to justify the decline and that strengthens my bearish sentiment. The market is tired after a 40% rebound from its March lows and it has run out of "drivers". Better than expected earnings and stability in the financial sector have run their course.

The headwinds are stiff. We are right at the 200-day moving average and we are right at a long-term downtrend. The most recent rally has been concentrated in a very narrow group of stocks (commodities and big-cap tech). That is not healthy for a sustained breakout. On a fundamental basis, we continue to see big job losses and interest rates are rising. 30-year mortgage rates have risen 1% in the last month and traders are hawking interest-rate yields. Every other week, the Treasury will hold bond auctions to raise more than $1 trillion this year. We made it through last week's auctions unscathed, but we have 3-year, 5-year and 7-year auctions next week. The bulls will continually be dodging bullets.

This morning, we saw a huge jump in housing starts. While that number seemed encouraging, it was primarily due to a spike in multi-family construction. That number was down huge in April and up huge in May. I believe this number was grossly understated in April and as a result we are seeing a big rebound. The Producer Price Index came in better than expected and inflation does not seem to be an issue (at least at the producer level).

Bank of America announced that its credit card default rate rose to 12.5% in the last month. That is a 2% jump from 10.5% in April. A month ago, they predicted that their credit card default rate could rise to 24% before this economic cycle runs its course.

The economic news this week is fairly light and the releases have not typically had a big market impact. Tomorrow, we will get the CPI. Consumers are getting hit from all sides and a "hot" number would weigh on the market. Gasoline prices are on the rise, lines of credit have been reduced, interest rates are on the rise, taxes are going higher (federal, state and municipal) and wages are declining. These are all chipping away at our purchasing power. Consumption makes up 70% of our GDP and without it, an economic recovery won't materialize.

I can see cracks in the dam and I believe we are about to see a decline. The VIX spiked yesterday and uncertainty is on the rise. I am buying puts on defense stocks and restaurant stocks. A close below SPY 92 would violate the uptrend line from March and it would spark additional selling. This market has been more resilient than I expected and that means we need to tread cautiously when establishing bearish positions. Scale in gradually as the market continues to show weakness.

Daily Bulletin Continues...