Huge Breakout – Chance For Some Profit Taking Heading Into The Weekend!

Yesterday marked one of the busiest days of earnings and the reaction was positive. The market rallied through SPY 96, taking out the highs from June. That breakout spawned short covering and advancing stocks outnumbered decliners by almost 9 to 1.

Better-than-expected continuing claims and a drop in initial jobless claims helped to spark the rally. Home sales also improved by 3% and analysts have been waiting for signs of a bottom.

From yesterday's close to this morning's open, there have been a tremendous number of earnings releases. Microsoft and Amazon missed their numbers and they are weighing on tech stocks. In the early going, the market has been able to hold yesterday's gains.

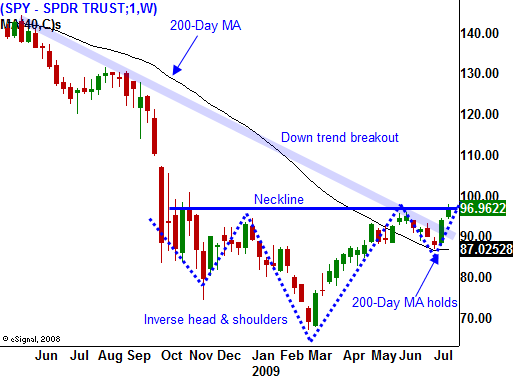

The market is very overbought at this stage, but it has accomplished a two significant technical breakouts. First of all, the market rallied above the downtrend line that dates back one year. It found support at the 200-day moving average and it rallied right through that resistance. In today's weekly chart (which is more significant than a daily chart) you can see the inverse head and shoulders formation. Yesterday's rally broke through the neckline. If the market can hold this level for another week, we will have a monthly close above the 12 month moving average. That is a long-term indicator that I follow and it would be bullish.

Regardless of my long-term bearish perspective, this move has to be respected. If traders believe that an economic recovery is unfolding, they won't wait for the actual numbers to confirm their forecast.

I won't chase this market and at this stage the best strategy is to sell out of the money put spreads on strong stocks. That will keep me a safe distance from the action. My bias has shifted a slightly bullish and I will "buy the dips".

Although the market has broken out, I would not aggressively take bullish positions. Part of the move was short covering and I would not be surprised to see the market pullback below SPY 96. That will shake out many of the speculators who got long on the breakout. We've already seen shorts get caught during the head and shoulders breakdown three weeks ago.

Cyclical stocks are rallying, but revenues have deteriorated. Transportation stocks have disappointed and they are not looking for a recovery this year. Oil inventories are still running high and one of the first signs of a sustained economic turnaround will be a draw on energy supplies.

In addition to earnings next week, we will get durable goods orders, home sales, initial claims, GDP, the beige book and Chicago PMI. Perhaps the most significant event will be the $110 billion in bond auctions. Rising interest rates could provide a stiff head wind for this market.

Once the earnings releases closely and look for strong stocks to sell out of the money puts on. Keep your size small and wait for a better opportunity to get long.

For today, look for choppy action. I would not be surprised to see a little profit-taking heading into the weekend after such a big run-up.

Daily Bulletin Continues...