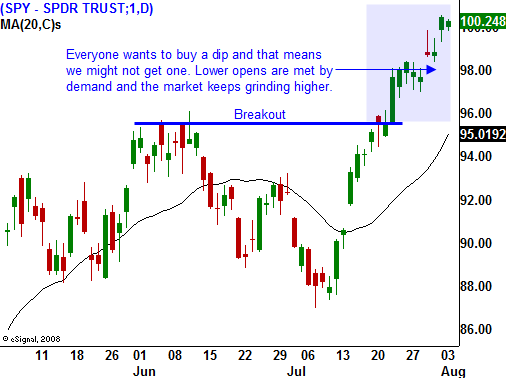

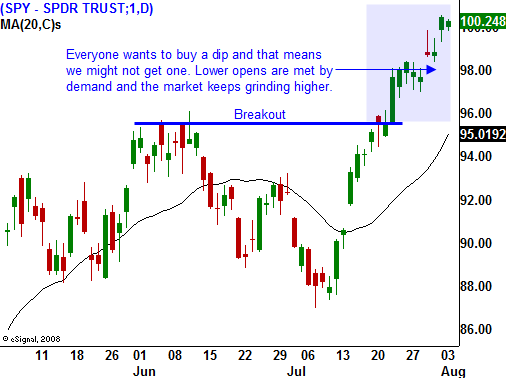

Asset Managers Looking To Buy The Dip Might Not Get One At This Level!

The market continues to surge higher. Yesterday, beginning of the month fund buying helped to push prices to a new relative high and the S&P 500 closed above 1000. Construction spending and ISM manufacturing rose more than expected and that also helped. Economic data is showing gradual signs of improvement and the market has been rallying on the news.

This morning, pending home sales rose for the fifth consecutive month and it beat estimates. The index rose 3.6% to 94.6. Consumer spending rose by .4% in June and that was slightly better than expected. Almost 70% of our GDP comes from consumption and this is an important improvement.

Even when the economic news is dismal, bulls are able to find the silver lining. Tomorrow we will get the ADP employment index, factory orders and ISM services. If the ADP employment index comes in better-than-expected (and I think it might) the market will jump higher. If it misses expectations, I believe it will be discounted and traders will wait for Friday's Unemployment Report.

Initial jobless claims have been coming in better-than-expected over the last month and that bodes well for Friday's unemployment number. If people are losing jobs at a slower rate, the market will stage a rally. Analysts are looking for a trough in unemployment and this might signal that we are 4-6 months from the bottom.

Traders want to "buy the dip" and that makes me think that we might not get one. Every time the market opens lower, buyers step in and each time they have been getting a little more aggressive. Last week, we had the perfect opportunity for a pullback and it looked like we would test the SPY 96 breakout level. By the end of the day, bulls stepped in and the decline was quickly reversed. I suspect many Asset Managers are under-allocated and they have to place money.

The market has broken above a long-term down trend line, it tested the 200-day moving average and that support held and it has broken above the neckline of an inverted head and shoulders formation (1-year chart). These are all very bullish technical events and the momentum should continue.

I am skeptical of this rally on a longer term basis, but I will cautiously get long. The higher it goes, the better the future shorting opportunity. It will take years for us to pay for all of the bad decisions that have been made and we are buried in debt. Once the government's spending spree has ended I don't see another catalyst. The cash for clunkers program has stimulated consumption and it is another example of how we are stealing from our future. Why should taxpayers help to pay for their neighbor’s new car? Taxes will spike in the coming years to pay for all of this nonsense and that will have a dramatic long term affect on consumption.

I am selling puts on strong stocks that have released solid earnings. I'm particularly interested in companies that have top line growth. I am distancing myself from the action and I want to make sure that there is support between the stock price and the strike price I'm selling. As long as the SPY stays above 96, I will keep my short put positions on.

We are entering a seasonal period where volumes tend to fall off. Earnings season has almost passed and after this week, 85% of the S&P 500 companies will have announced. The Unemployment Report has been a key economic release each month and after Friday, I believe trading activity will decline. The path of least resistance is higher and bears will not stand in the way.

Look for a quiet day today with a fairly tight trading range. Early weakness was easily overcome and advancers outnumber decliners by 2 to 1. Stay bullish and keep their size small.

Daily Bulletin Continues...