We Are Likely To See A Rally Through Friday – Scale Out Of Bullish Positions On Strength!

For the last week I have been mentioning that quadruple witching could play an important role this week. Once the upward momentum established itself, option expiration fueled the rally. The market convincingly made a new high for the year and prices closed right on their high of the day Wednesday. Option volume was very heavy and there is a speculative feel to the price action.

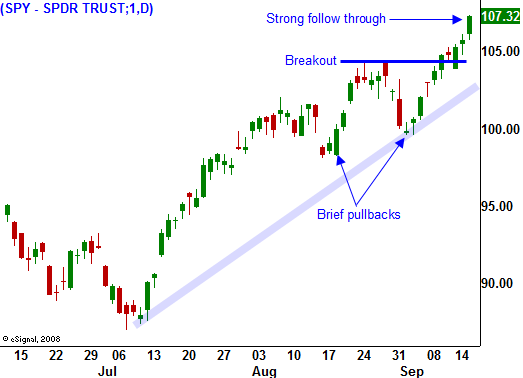

Many traders have been looking for seasonal weakness in September and they have been left behind. Likewise, Asset Managers who are under allocated have been scrambling to place money. They are getting more and more aggressive and that is why the two small dips in the last two months have been shallow and brief.

The market has all the ammunition it needs to move higher. Earnings beat expectations by a large margin last quarter and we are likely to see earnings growth in Q3 due to easy comparisons from a year ago. This alone could fuel a year-end rally if the market does not get ahead of itself. Interest rates have been drifting lower and the massive bond auctions have gone well. The Fed is also committed to keeping rates low. Inflation is not putting upward pressure on yields and this week the CPI and PPI were tame. Economic statistics continue to show gradual improvement and the numbers are "less bad".

This morning, initial jobless claims were 545,000 and that was better than expected. The week-to-week numbers fluctuate and most analysts follow the four-week moving average. It fell by 8700 this week and it stands at 563,000. Housing starts rose 1.5% and building permits climbed 2.7%. The deep trough in the housing cycle may have hit bottom.

The economic releases next week include LEI, initial jobless claims, durable goods, existing home sales and consumer sentiment. All have shown gradual improvement in recent months. Durable goods orders should increase because of cash for clunkers, but traders will see through that temporary spike. The FOMC will also meet next week. Their comments have not changed much in the last few months and I expect their policy to be bullish since they are likely to keep rates low.

The option expiration rally this week is starting to feel a bit frothy. Prices are likely to move higher right into the close on Friday. However, if we rally another 30 S&P 500 points, we are likely to hit resistance and we could see a pullback early next week. This market has tremendous upside momentum and I would discourage trying to pick a top. If you have bullish positions, set targets and scale out on strength. Be patient and wait for a pullback to reenter. This strategy has worked very well since May.

I have been selling out of the money put spreads on the way up and they will expire tomorrow. The slate will be wiped clean and I can reevaluate next week. I am likely to establish a few put credit spreads early next week, but I will not get aggressive until I see a pullback that finds support.

I expect choppy trading with a bullish bias the rest of the week.

Daily Bulletin Continues...