Look For A Quiet Rally Today Ahead of Merger Monday and Good Earnings Next Week!

Let earnings season begin! The handful of companies that have released third-quarter earnings have performed well after the announcement. The market looks strong and economic data continues to gradually improve.

Yesterday, initial jobless claims came in much better than expected. As I noted last week, I thought that last week’s initial claims miss was over exaggerated and things would even out this week. That’s exactly what happened. The week-to-week number is very volatile and that's why it's important to watch the four-week moving average. Continuing claims also dropped dramatically and that is a good sign.

Retail sales came in much better than expected, but the results were still pretty flat. Analysts had been expecting worse and that provided some upside momentum as well.

I expect financial stocks to post great numbers next week. The spread between borrowing and lending rates has never been better and write-downs will subside. In order, we will hear from J.P. Morgan Chase (Wednesday), Citigroup, Goldman Sachs, Bank of America and General Electric. These earnings releases will fuel a rally in the financial sector. Large-cap tech stocks will also release earnings. They include Intel (Tuesday), Google (Thursday) and IBM. Each of these companies posted solid earnings last quarter and they are trading at their highs of the year.

The economic releases will take a back seat to earnings. The calendar includes retail sales, the FOMC minutes, initial claims, CPI, Philly Fed, industrial production and consumer sentiment. I don't see any of these numbers spoiling the rally.

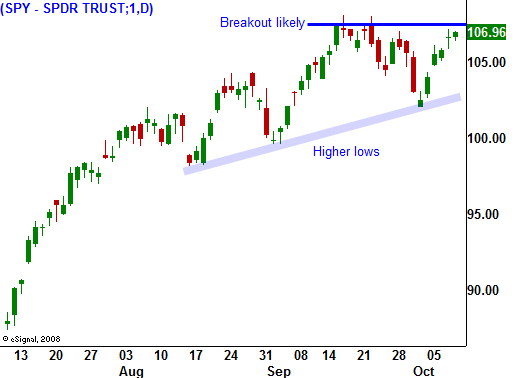

As the week unfolds, a gradual move higher could easily spark option expiration buy programs. By the time the week is over, I expect a breakout to new relative highs.

The action today is very subdued. However, M&A is picking up and we could see a rally this afternoon. Traders won't mind going home long ahead of "Merger Monday". Asian markets were up strong and that will provide a tailwind today. I am selling out of the money put spreads heading into next week.

The market is likely to take two steps forward and one step backwards during this final phase of the rally. Make sure you are buying dips and selling rallies. If you don't want to time the market, sell out of the money put credit spreads on strong stocks. I have been focusing on companies that will not release before option expiration. After next week, I will start selling November puts on companies that have posted great numbers.

Daily Bulletin Continues...