Another New High and Room To Run Into Thrusday’s Close!

My forecasts have been accurate. As predicted, CSX, Intel and J.P. Morgan rallied after earnings announcements. The market is making a new high for 2009 and 70 stocks in the S&P 500 are hitting 52-week highs.

Transportation is one of the fundamental indicators I use to forecast an economic recovery. This sector has been lackluster and shipping volumes have me skeptical. Revenues were down 23% (primarily due to fuel surcharges since oil prices have come down) and that is acceptable. However, overall rail activity is down 19% year-to-date compared to 2008. Because the decline in shipping volume was smaller than it was in the second quarter, CSX feels that we may have seen a trough. Rail is the cheapest way to ship goods and they have maintained pricing power. They will show the first signs of recovery. "Less bad" does not have me convinced that a recovery is underway. Truckers have been weak and they are not as optimistic.

Intel knocked the cover the ball. They handily beat revenue and earnings expectations. They also raised guidance by a large margin for next quarter. The statements were positive and analysts project a rebound in PC demand. Altera did not have the same success and their earnings were down 40%. They do expect revenues to increase 6-10% sequentially and that has the stock trading higher.

J.P. Morgan Chase posted fantastic results. They had EPS of $.82 when analysts were expecting $.52. Revenue jumped from $14.7 billion to $26.2 billion. Investment banking and underwriting provided a huge boost to revenues. Consumer credit losses were $9 billion compared to $5.7 billion a year ago. The stock is trading higher, but it has stalled after jumping to a new relative high.

This is where the rubber meets the road. Earnings are likely to beat expectations, but that is already priced into the market. The S&P 500 has rallied 60% from its March low and valuations might be getting stretched.

Banks need to lead this rally. An economic rebound can only happen if credit starts to ease. Businesses and consumers need capital to increase spending. Big banks will release earnings over the next week and we need to see a sustained move higher. The consensus is that regional banks will continue to struggle and I am expecting a muted reaction when they release.

Major tech stocks will lead off earnings season. They have been solid performers and the expectations are high. Intel got the ball rolling, but IBM and Google will have to ignite a rally as well.

If the market can't rally on solid earnings that beat expectations, it will top out. That reaction will tell me that all of the good news is priced in and that the market will no longer be satisfied with "less bad". It doesn't mean that we will instantly reverse and head lower, but we will fall in to a tight trading range. Asset Managers that are under-allocated will still put money to work and Wall Street will prop up prices so that they can make nice bonuses after a 2-year dry spell. Those who want to play it safe will start taking profits and the range will be established.

I will continue to play strength into the end of the year by selling out of the money put credit spreads on strong stocks. Key technical support levels will have to be breached for me to abandon this strategy.

If employment numbers continue to deteriorate into year-end and other economic data fail to show gradual improvement, we will be due for a decline in the first quarter of 2010. This could be the "double dip recession" that many analysts (myself included) are predicting.

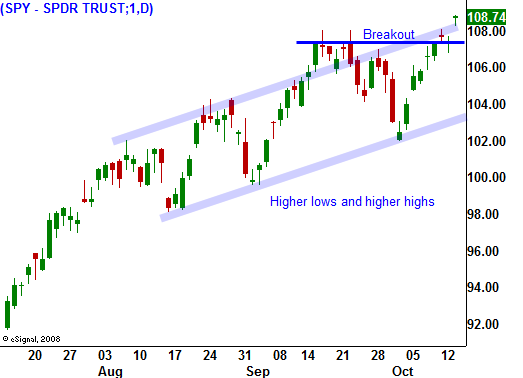

The market has broken out to new highs and the rally has been orderly. That is exactly what institutional option traders want to see. If they suspect a gradual grind higher this afternoon, they will leg out of hedged positions and they will fuel the rally. The FOMC minutes will be released this afternoon and they will confirm the Fed's accommodative stance. This will be bullish and the market will close near its highs of the day. Furthermore, bears have been humbled and they dare not take short positions ahead of earnings from IBM and Google tomorrow.

Stay long, but look for profit taking opportunities before tomorrow's close. Stocks should rally the next few days, but resistance will start to mount as we approach SPY 110. That move will fill a major gap from a year ago and we could hit temporary horizontal resistance just above that level.

Daily Bulletin Continues...