Decent Ecomomic Numbers Are Supporting The Market Today. Expect Volatility This Week!

Last week, the market showed serious signs of strain. We have not seen sustained selling pressure like this since July.

Earnings have been good and almost 80% of the announcements have beaten estimates. Only 100 of the S&P 500 companies have yet to release. The meat of earnings season has passed and the surprise element is gone. Before tomorrow's open, there aren't any major earnings announcements that will drive the market.

Trading this week will be heavily influenced by economic data. This morning, ISM manufacturing was much better than expected. It has increased for three consecutive months and it hit 55.7 in October. That is a 3 1/2 year high and it represents economic expansion. Manufacturing only accounts for 20% of our economic activity and while it is important, I believe the ISM services number due out later this week will be more significant. Pending home sales rose to 6.1%. That was largely aided by the first-time home buyer tax credit that will expire soon. Construction spending rose .8% after falling last month. Overall, these numbers were good and the market is bouncing after the deep selloff last Friday.

Tomorrow's economic releases are light, but things will heat up Wednesday. The ADP employment index, ISM services and the FOMC will influence trading. I am expecting weak employment to be reflected in the ADP number and it could spark profit-taking. ISM services and the FOMC will be positive for the market, but I doubt they will be able to offset employment concerns. Initial jobless claims have not improved and the four-week moving average is starting to flatten out. It has been declining for many months and now we are not seeing much improvement. Worries of a jobless recovery are surfacing ahead of Friday's Unemployment Report.

I believe that current conditions will overpower future concerns through year end. Earnings have been good and guidance has been decent. Interest rates will remain low and the Fed will not change its policy. Economic numbers continue to improve gradually and "less bad" conditions will sustain recovery hopes. Asset Managers still have money to place and Wall Street would love to have the market close right at this level so that your end bonus checks can get cut.

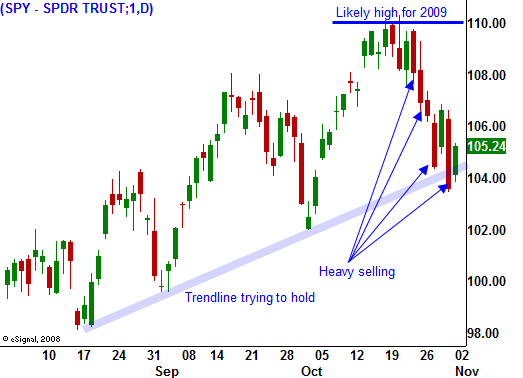

I believe we will see nervous trading this week and a support level will be established. That will set up excellent put writing opportunities on strong stocks. We will get a nice little year-end rally, but I also believe the highs for 2009 are in. Selling pressure has been heavy and major resistance has formed.

The market has tested the uptrend line that dates back three months and for the time being SPY 104 has held. I still feel that SPY 102 is a more critical level. Once a firm support level has been established, the market could easily fall into a trading range the rest of the year.

Retail and tech have been strong relative to other sectors. I also like a number of emerging market stocks. Stick with solid earnings and companies that have been able to hold up during this market decline. Line up your candidates and be ready to sell out of the money put credit spreads. If you have played the market decline, be prepared to take profits after the Unemployment Report.

Daily Bulletin Continues...