“Merger Monday” Provides A Spark. This Is The 8th Bullish Monday In A Row!

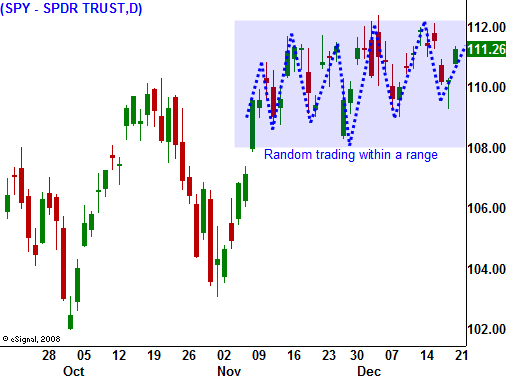

Prepare for a light volume week with choppy price action. Resistance is building and I believe it will hold through year-end.

Last week, the market took another shot at SPY 112. Strong seasonality, dovish comments from the FOMC and bullish open interest in call index options were not enough to spark sustained buying. Profit-taking is strong at this level as traders lock-in profits.

The last five trading days of the year are normally bullish and the "Santa Claus Rally" would officially start this Thursday. If it fails to materialize, it is a bearish sign for 2010.

This morning, "Merger Monday" is alive and well. There were many deals in healthcare/biotech over the weekend. That is giving us a jumpstart for the week. GDP will be released tomorrow and consensus estimates are for 2.8%. Last month, economic growth came in lower than expected. On Christmas Eve, durable goods orders will be released. It is a volatile number and it came in light a month ago. Initial jobless claims have increased two weeks in a row and that is not a good sign. I don't believe employers will lay people off heading into the holiday and we should get a decent number. In aggregate, the numbers should be slightly negative, but seasonality will neutralize any selling.

After Christmas, the economic releases are very light. They include consumer confidence, Chicago PMI and initial claims. If a "Santa Claus Rally" is in the cards, there's nothing (except profit taking) to stand in the way.

Capital gains taxes are slated to increase next year and that could create additional selling pressure next week. I also believe retail sales will come in below expectations as consumers tighten their belts. Retailers will blame weak demand on bad weather, but holiday spending has been sub-par for weeks.

The trading action will be light and there is no need to take unnecessary risks. I am selling out of the money call credit spreads with the notion that resistance will remain intact. If SPY 109 fails this week, I will buy a handful of puts. If we have a breakdown next week, I will be a little more aggressive. I don't want to be head-faked during light volume sessions.

The tone for today is set. Look for the positive price action. Resistance is close at hand so this rally should be contained. Activity is likely to fall off as the day progresses.

Credit issues in Europe and the US will haunt us during first half of 2010. Economic numbers will flatten out and the recovery will stall. The downside risks outweigh the upside potential.

Daily Bulletin Continues...