Interesting Trading Opportunity Heading Into Thursday!

Yesterday, the market tried to push higher in very light volume. At the end of the day, the gains were negligible.

Today's action feels like déjà vu. The market opened marginally higher and now it has drifted back to unchanged. We are at the highs for 2009, but shorts have not scrambled to cover positions. That is because they covered months ago and they have not re-established positions. If they had, we would see rising (not falling) implied volatilities. Resistance at this level is strong and profit-taking is keeping this rally contained.

There might be a trading pattern that we can take advantage of tomorrow. After being up 29 years in a row, the NASDAQ has been down 8 straight years on the last trading day. The Dow has been down 9 of the last 12 and it has posted a loss four years in a row on the last day. I may buy a handful of puts tomorrow for a very short-term trade. I will focus on liquid technology stocks that have tight option bid/ask spreads and have run up in the last week. They will be the most vulnerable to profit-taking.

Consumer confidence came out better than expected this morning. I don't put a lot of weight into that number and the market barely moved. Tomorrow we have Chicago PMI and Thursday we have initial claims. Neither release will have a big impact on the market.

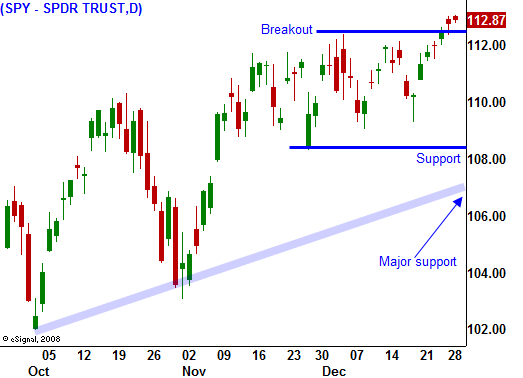

I am anxious to buy puts, but I have to let this breakout run its course. If the market easily pushes below SPY 112, I will start buying puts. That level was resistance and now it is support. If enough speculators bought into the Santa Claus rally, we could see a swift reversal on that breakdown as they bail out of long positions.

In light volume, there is not a lot of predictability. We need to wait for normal activity to resume. The best bearish trade will come on a breakdown below SPY 108 and SPY 107 on heavy volume. Until then, it is best to keep your powder dry.

Advancers equal decliners and the market is likely to stay in a tight trading range today. Look for more the same tomorrow.

Daily Bulletin Continues...