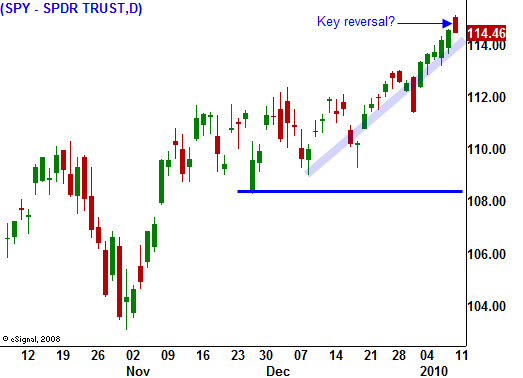

A Reversal Off Of A New High – Afternoon Selling Would Be Bearish!

Last week the market finally staged a decent breakout. Each day, it opened flat and gradually moved higher throughout the day. In today's chart you can see the long green bodied candles that resulted. This is in stark contrast to the random trading we saw weeks before. The market would gap higher, establish a fairly wide range and close near its opening price. That pattern results in very small bodied candles with long tails. The conclusion to be drawn is that real buying materialized last week.

The market was able to shrug off a horrible Unemployment Report. Analysts had been revising their estimates upwards throughout the week and most were looking for positive job growth. Heading into the week, consensus estimates were -35,000 and we even missed that number by 50,000 jobs. On the surface, a loss of 85,000 jobs does not seem that bad compared to where we came from a few months ago. However, it is a dramatic shift from the 4,000 jobs that were created in November. Swept under the carpet was the fact that a major adjustment was made. The Department of Labor Statistics lopped 600,000 workers from the work force. These people have given up hope and they are no longer seeking employment. If this number had been included, the picture would be much worse. This is just another example of how the numbers are manipulated.

I would never suspect China of rigging their numbers (not). This morning, their trade figures came in very strong. Exports soared 17.7% year-over-year when an increase of 4% was expected. Imports jumped by 55.9%. This large disparity between imports and exports resulted in a decrease in China’s trade surplus of 4%. I still feel that they are overproducing and they will be stuck with huge inventories as consumption is slow to recover.

Alcoa will release its earnings after the close today. The run-up in steel stocks during the last week has been ridiculous. The fundamentals don't support the move and these stocks are priced for a full blown economic recovery.

Earnings won't really fire up until next week. The market is likely to rally ahead of the releases. Bank stocks will dominate the action and since they have lagged the market, there is upside potential. This will push the market to a new relative high and set us up for a decline in February. Stocks have gotten ahead of themselves and if the unemployment picture does not improve, fear of a double dip recession will surface. Right now, the market is discounting any chance of that happening and a full recovery is expected.

I believe initial claims and CPI will be the numbers to watch this week. The market does not want to see job deterioration after last week’s number. Soaring commodity prices could weigh on the CPI and inflation will put upward pressure on interest rates.

Today, the market hit a new relative high and it backed off right away. If bulls decide to pull their bids, the market could sell off this afternoon. That selling will accelerate as bullish speculators start to bail on their positions. There was a tremendous amount of call buying last week and bullish speculators could easily get flushed out of this market.

I am not chasing prices and I am not buying calls. I am lining up put purchases and I have placed orders to buy them when stocks break below technical support levels. If stocks start to crumble, my orders will be triggered. If the market continues to rally, I will patiently sit on the sidelines.

I have nothing more than a gut feeling to go on today. I feel that we could see afternoon selling as Friday's number weighs on the market. A breakdown below SPY 113.50 would be very bearish. That would be the key reversal and we can expect a few days of selling pressure if that happens.

Daily Bulletin Continues...