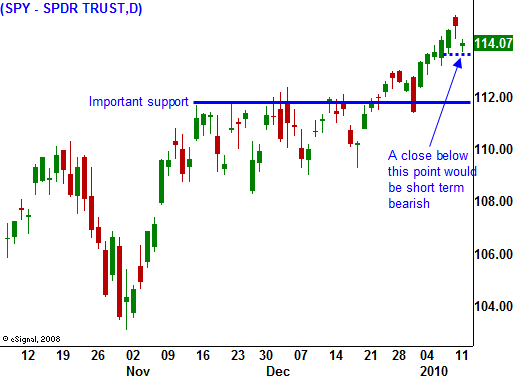

A Close Below SPY $113.50 Would Be Bearish. Look For Selling Wed If That Happens!

For the 11th straight Monday, the market opened higher and once again we started the week off on a good note. As the morning progressed, the market quickly backed off from a new relative high and a warning shot was fired. I mentioned that a close below SPY 113.50 would be bearish and that did not materialize yesterday. However, the selling pressure is back again this morning.

After Monday's close, Alcoa announced weaker than expected results. The stock is down 10% after the news and all commodity stocks are trading lower. I've heard a few analysts argue that the move is related to past performance and that traders need to focus on aluminum prices and guidance. I would argue that point. The stock rallied almost 50% in the last month and great expectations for next quarter were priced in. The company lost money and revenues were down even though prices increased 9%. The stock got ahead of itself and expectations were too high.

Commodity stocks and cyclical stocks have been flying on the notion that a full-blown recovery is underway. I am not nearly that optimistic and I believe last Friday's employment “miss” was the first sign that economic growth will hit a snag. Small businesses are very nimble and they have their finger on the pulse of the economy. In December, the sentiment of small business owners dropped for a second straight month. They comprise 50% of economic activity and they are not hiring until they see an uptick in demand.

Today, the Federal Reserve boasted that its banks paid $46 billion to the U.S. Treasury in 2009, increasing their net income by 47% to a record $52 billion. Many of the banks did not even want TARP loans in the first place and they easily paid the money back. What the Fed did not mention was that Fannie Mae, Freddie Mac, AIG and GMAC could collectively drain $1 trillion from the Treasury's coffers by the time this crisis is over.

Last week, bullish speculators rushed in and bought an extraordinary number of calls. Today, they are getting flushed out of the market. As they bail, the selling pressure will mount. If we close below SPY 113.50 today, you will see selling pressure tomorrow. If SPY 112 falls, we have a failed breakout and profit-taking could really settle in.

The news is very light tomorrow. Oil inventories and the Beige Book are on deck and they should not have a big impact on the market. Thursday's initial jobless claims number will be scrutinized and traders will be trying to determine if we are going to see weaker than expected employment in back-to-back reports. Retail sales will also be watched closely Thursday. I expect good results, but the sector is near its high and there is room for a pullback on the actual news. Friday's CPI number will be very important. If inflation starts creeping in, interest rates will move higher.

There are large bond auctions this week and traders will also be watching the bid to cover. This afternoon, $40 billion in three-year notes will be auctioned. That news will be released at noon central time and it could weigh on the market.

I have been bearish and I am looking for a good entry point for my put purchases. If we close below SPY 113.50, I will buy some on the closing bell. If we break below SPY 112, I will buy more.

The market momentum favors the downside today and I believe we will see selling into the close.

Daily Bulletin Continues...