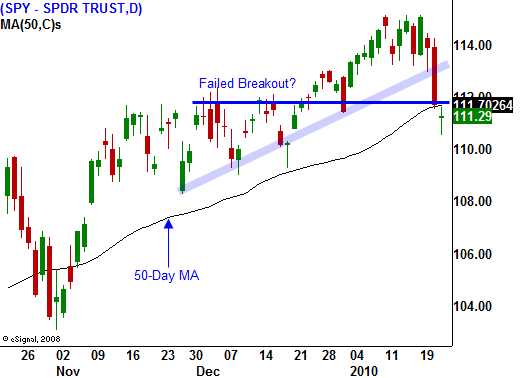

Stay Short As Long As the SPY Closes Below $112. Buy More Puts Below SPY $108.

A number of cross-currents hit the market this week and there are "cracks in the dam". Current conditions would support a market rally, but it's the future traders are worried about.

Earnings have been good and they are beating expectations. Unfortunately, that is already priced into the market and traders aren't thrilled about the guidance for Q1. Bank stocks are out of the way and they did not rally as I expected. Huge write-downs and new bank regulations weighed heavily on shares. Since the closing bell yesterday, American Express, CapitalOne, Google, Advanced Micro Devices, Western Digital, McDonald's, and General Electric all posted solid numbers. Most of them are trading lower.

The big earnings release on Monday will be Apple. The expectations are high and they are likely to deliver. We'll see just how much upside this NASDAQ leader has. Judging from Intel, IBM and Google, the stock is likely to decline after the release. We will also hear from many cyclical companies and I believe the expectations are too high. Rail stocks have posted dismal shipping volumes and I do not believe this economic recovery is as robust as many believe.

Interest rates are also low and next week's FOMC meeting should be a non-event. Fed officials will keep rates low for as long as possible. There is the potential for upward pressure in coming months. This week, China said its GDP rose 10.7% and they could raise rates as soon as March.

Next week, existing home sales, consumer confidence, new home sales, initial claims, durable goods orders, GDP, Chicago PMI and consumer sentiment will be released. GDP will be released Friday and analysts expect a 4.5% growth rate. That seems overly optimistic and even if we hit that level, it is likely to be revised lower (similar to Q3 GDP). New home sales have been horrible and I expect that to continue. If we get another bad initial jobless claims number, serious doubt will be cast on the Unemployment Report due out in two weeks. That would mark three consecutive weeks where jobs have declined and fears of a double dip recession will surface.

The market hates uncertainty and Obama is adding to the problem. Around every bend there is another program and another committee that targets a specific group. Cash for clunkers, cash for caulkers, union exemptions for Cadillac health care, duties on Chinese steel, healthcare reform, carbon cap and tax, banking reform, capital gains taxes... I'm sure I've missed many other examples, but there is constant tinkering with the current system. His eye is not on the ball and jobs are the key. Voters showed up in droves during this week's Massachusetts Senate election and a Democratic seat that was held by the Kennedys for decades fell to the Republicans. A warning shot has been fired and Democrats are back on their heels.

We are lead to believe that large corporations are the all mighty evil empire. All of the cash held by S&P 500 companies totals about $820 billion. Over the last 10 years, corporations have scratched and clawed to build up balance sheets. In one year, our government has run a deficit twice that large. Our government is likely to raise corporate taxes and blow through that hard earned capital in a heartbeat. Politicians want to gloat about their success with TARP. That $285 billion program was forced on many financial institutions and it should not be a surprise that 75% of it has been paid back. What you don't hear about is the $1 trillion black hole created by Fannie Mae, Freddie Mac, AIG and GMAC. The government continues to backstop these entities and they are burning through cash at an alarming rate. The credit crisis has not ended; it has just shifted over to our government.

Misery loves company and the EU is in worse shape than we are. I believe the first market driving news event this year will come from a European country that defaults. It could be Greece, Spain, Bulgaria, Latvia or any number of other smaller countries. The European Central Bank has already stated that it will not lend support and this is a potential house of cards.

Oil demand has not risen during this supposed global economic recovery and I do not believe the statistics coming out of China. They could be sitting on stockpiles of inventory when consumption fails to recover. Transportation stocks in the US have been reporting weak volumes. Inventories are low and businesses are not replenishing.

Bullish sentiment has been at extremely high levels during the last two months and some of that "fluff" needs to be taken out. There is enough uncertainty to spark a sharp, swift decline. I believe we have seen the market highs for the first half of the year. I'm not looking for a sustained decline - yet. I feel we will pull back sharply and prices will find support in the next few weeks. Then we will stabilize. We need to see other signs of weakness for a prolonged pullback and I believe they will surface in March or April.

Stay short and use stops to lock in profits. There are no absolutes on how to place stops. Each stock and every trading day is different. As a simple guideline, take profits if the stock trades higher than the prior day’s high. We’ve been waiting for this – enjoy the ride.

Daily Bulletin Continues...