Look For A Bounce This Week And More Selling Next Week!

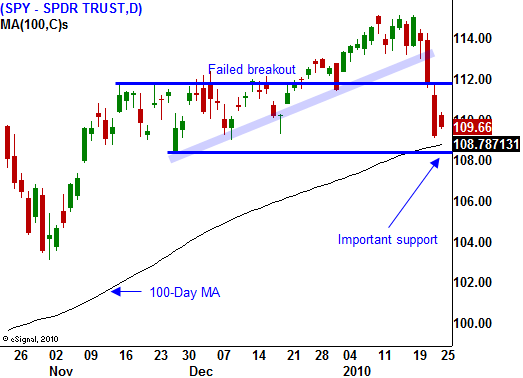

Last week, the market finally cracked. A possible rate hike in China, uncertainty about Ben Bernanke's reappointment, new banking restrictions and a weak initial jobless claims number were to blame. The SPY fell below important support at $113.50 and it quickly took out $112. As the selling accelerated last Friday, we were within striking distance of SPY $108.

The long-term trend line from last March has been broken and the market sits right above the 100-day moving average. If SPY $108 fails, we will see another down leg.

This morning, prices have stabilized and the market is trying to work its way higher. Fed Chairman Bernanke is gaining support and it is likely that he will be reappointed.

This is a major earnings week and 25% of the S&P 500 will report. Apple will release after the close and it will be important to the entire tech sector. They tend to under promise and over deliver. The stock has pulled back from its highs and there is room for it to jump after the number. Many cyclical stocks will be releasing earnings and they have run up on the notion that an economic recovery is underway. This quarter's performance should be good, but I believe the guidance will be weak.

Existing home sales were a disappointment this morning and I believe new home sales will be a disappointment on Wednesday. The FOMC meeting will be a non-event Wednesday. They will likely describe improving conditions and a fragile recovery. Durable goods orders are very volatile and the number does not normally drive the market. Initial jobless claims have been worse than expected two weeks in a row and if Thursday's number disappoints, the market will decline. Traders will get nervous about the upcoming Unemployment Report. Without jobs, the chance of recovery is small. On Friday, GDP will be released. The consensus estimate is for a 4.6% growth rate. That seems overly optimistic, and I expect to see downward revisions in February and March, similar to the third quarter revisions that dropped us down to 2.2% from an initial level of 3.5%.

The market will digest some of the uncertainty from last week and I believe we will see a bounce. Once the rebound runs its course, nervousness will set up ahead of next week's Unemployment Report. I also believe that cyclical stocks and tech stocks will weigh on the market as the week progresses. They are over extended and the guidance will not support current price levels.

I have many put positions that have made great money in the last three days and I don't want to squander my profits. I will exit some of these positions today and I plan to be flat in the next two days. As the market rallies, I will start placing orders to buy puts on the next pullback. I will use a trailing buy stop order so that the order follows the stock higher. When the stock does reverse, the order will get triggered.

I have been waiting for signs of the top and I believe the highs are in for the next six months. The market is transitioning and I am prepared to sell into rallies. Look for a bounce this week up to SPY 112 and a decline next week.

Daily Bulletin Continues...