The Market Is Very Resilient – Sell Credit Spreads and Be Patient!

Yesterday, the market staged a nice rally and it finished near its high of the day. The credit crisis in Europe is not imminent and traders are focusing on solid earnings.

Overnight, the Fed raised its Fed Funds rate by .25%. It will now cost banks more to borrow money from the Fed. This move was largely anticipated, rates can't stay at zero forever. The market is interpreting this as positive news. Banks have improved their balance sheets enough to attract private equity and they aren't as dependent on the Fed.

This year, there will be monetary tightening. We have never seen this level of liquidity and it needs to be reined in. The Fed outlined its exit strategy for quantitative easing and it will start with mortgage rates. The government will stop buying mortgages in the next few months and those rates will rise. Eventually, the Fed will raise discount rates. For the time being, they plan to keep them low.

Bank profits will decline as a result of the Fed’s action. Now, the spread between the borrowing and lending rate is smaller. I am surprised at how well financial stocks are holding up. They have diluted shareholder value by issuing massive amounts of stock. Regulators will impose restrictions on banking activity this year and that will hurt profits. The credit crisis is far from over. One out of three homes has negative equity and one out of six homes is either delinquent or in foreclosure. The unemployment picture is weak and yesterday's dismal initial jobless claims number casts doubt. The major banks also have exposure in Europe. Given all of these factors, I feel this sector presents a great shorting opportunity.

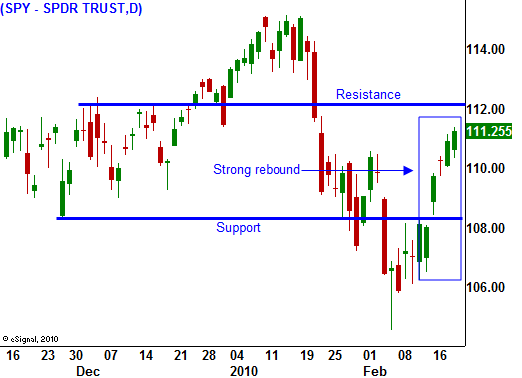

As I mentioned yesterday, it's business as usual. The market will continue to trade off of current information and it will discount the threat of a financial collapse in Europe until it actually happens. This rally has momentum and the market is likely to test resistance at SPY 112 next Monday.

The economic news next week includes consumer confidence, new home sales, initial claims, durable goods, GDP, Chicago PMI and consumer sentiment. I don't believe any of those releases pack enough punch to spoil the current rebound. I am selling put credit spreads on strong stocks and call credit spreads on weak stocks. I am keeping my size small. My goal is to generate a little income while I wait for the situation in Europe to deteriorate. I also believe that jobs will be slow to recover in the US. In the next few months, census employment will offset layoffs by state governments. That plus the tail end of government stimulus will take a few months to play out. Employers plan to lay off more workers in the next month (Challenger, Gray and Christmas) and organic growth will not materialize. We might see job growth in the next few months, but that will taper off and the unemployment rate will creep higher.

Be patient. Look at a chart from 2007 and know that these credit situations can take many months to play out. As long as the market is above SPY 108, you should not be buying puts. The VIX is up and this is a good time to sell premium.

Daily Bulletin Continues...