Big News Events Will Drive The Action This Week!

This morning, the market is following its normal pattern of rallying on Monday mornings. Overseas strength and news that AIG is selling one of its insurance division's for $35 billion sparked optimism. End-of-month fund buying also provided a lift.

The overseas news was mixed. South Korea reported an 18% jump in exports after a 9% decline in January. These results eased concerns that a slowdown in China was forthcoming. Personally, these export statistics are so volatile that I'm not going to read much into them. A four-month trend would be much more meaningful and we need to watch for a trend.

China's PMI dropped more than expected. It fell to 52 in February from 55.8 in January. It is still above 50 and it indicates economic expansion. If China's growth stalls, global markets will decline. Europe and the United States are struggling. Without China, there's little hope for a global recovery. The Chinese government suspects that activity is reaching frothy levels and it has raised bank reserve requirements three times this year.

Manufacturing in the US slowed more than expected. This morning, ISM manufacturing came in at 56.5 for the month of February. That is down from 58.4 in January. The number is still fairly robust and a weak dollar helped to boost manufacturing. The recent dollar rally could impact this in future months.

Construction spending was weak and it fell .6%. Businesses are not reinvesting and they see storm clouds on the horizon.

Greece is almost out of money and they will be forced to hold a bond auction this week. Most analysts suspect that the EU (Germany in particular) will support the bond issue. They want to give Greece an opportunity to balance its budget over the next few months. As long as they are making a concerted effort, support will be provided.

This would be a smart move by the EU since so much is at risk. Greece is a relatively small problem in the grand scheme of things and there is no reason to start an avalanche. This type of support can continue for many months. Eventually, Portugal and Spain will join the bailout party and then the rest entire iceberg will be exposed.

There will be many important economic releases this week. They include the ADP employment index, ISM services, initial claims and the Unemployment Report. Friday's number will be the most important. Initial jobless claims have been on the rise three straight weeks and we are set up for disappointment.

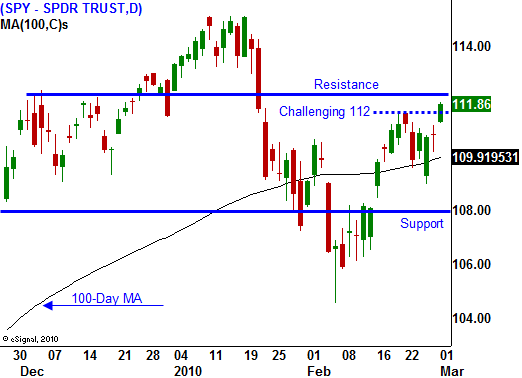

The market has rallied back up to resistance and I expect SPY 112 to hold today. I'm confident that a major decline lies ahead, but I will not buy puts until we have a breakdown below SPY 108. There is no reason to jump the gun. Great earnings, strong balance sheets and low interest rates can support a short-term rally. At this juncture, sell out of the money put credit spreads on strong stocks and sell out of the money call credit spreads are weak stocks. Keep your size small and generate income while we wait for the breakdown.

Daily Bulletin Continues...