The PIIGS Are Lining Up Big Bond Auctions – Greece Was Just The Beginning!

Yesterday, the market posted strong early gains and it made a new 18-month high. The momentum is strong and it looked like we might have a runaway market. However, as I mentioned in yesterday's comments, we still had to get through the bond auction.

The U.S. Treasury auctioned $32 billion in seven-year notes. The bid to cover was 2.6 and yields went up. Some would argue that this is a great sign. Higher interest rates mean that the economy is recovering. Corporate profits and tax revenues would rebound in that scenario. However, this is contrary to what the Fed Chairman said yesterday. He believes the recovery is very fragile and he wants to keep rates low as long as possible. As for corporate profits, they have been good because expenses have been slashed. Top line growth is still recovering.

There is another potential explanation for higher interest rates. It has to with our national debt and the pissing match that has broken out between the US and China. The Chinese are our largest debt holder and they have become net sellers of US Treasuries. When the demand for your bonds goes down, yields rise.

As I've been pointing out, our budget deficit is growing exponentially. It was at $2 trillion in the year 2000 and now it will grow to $15 trillion in the next year. Money is being spent like mad and today we learned about a $14 billion aid package to financial institutions and jobless homeowners. Two weeks ago, Congress passed a $155 billion package to extend unemployment benefits. To put this into perspective, our largest budget surplus in the last 40 years was $255 billion. We are spending that like chump change.

Traders aren't stupid and they know that the new health care program will cost trillions of dollars and it will put us further into debt. The risk associated with US Treasuries is increasing and that is one reason for the low demand. I am the minority when it comes to this viewpoint. Most analysts will say that the market is discounting the Fed’s intent to unwind quantitative easing. That might partially be true, but when analysts first saw how much money our nation would have to raise in the two-year period, they wondered how the market would react. It is possible that we are reaching a saturation point. Investors will still buy our bonds, just at a higher yield.

Again, most analysts would say that this is complete hogwash. We are the wealthiest nation in the world and our word is our bond. That used to be true 30 years ago, but our reckless ways will soon do us in.

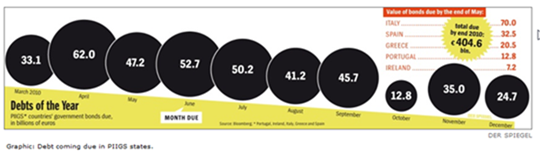

When a tiny country like Greece goes through hell to secure financing, imagine what will happen when England, Spain or Italy step up to the plate. We are going to see exactly how the market feels about all of this debt in the next 3 to 4 months. The PIIGS will have to raise a ton of cash and they have been waiting in the wings to see how the Greek situation plays out. In today's chart you can see how much debt they need to roll over. If the demand for these bonds is lackluster, you will see fear escalate quickly.

.

.

.

.

.

We have been trying to spend our way out of every recession and that approach has run its course. In two years, tax revenues will barely cover mandatory expenses (interest on our national debt and entitlement). All the additional essential expenses ($1.4 trillion) will push us further into debt each year.

The market is likely to focus on good earnings, solid balance sheets, mergers and acquisitions, low interest rates and decent economic releases. Next week, we will get many economic releases. They include personal income, consumer confidence, the ADP employment index, Chicago PMI, factory orders, initial claims, construction spending, ISM manufacturing, and the Unemployment Report. This morning, GDP came in as expected and the market liked the number. Many analysts are calling for major job growth in next week's number and the consensus estimates are for 200,000 new jobs. I have even heard estimates above 300,000. That would be great news. It will cause upward pressure on interest rates, but as I mentioned earlier this would be a good reason for them to move higher.

Higher interest rates will also greatly increase our nation’s interest expense. We have an average maturity of 4 years and we will continually be rolling our debt over. The GDP (tax revenues) will have to rise considerably to offset this increase.

I still feel that Americans are paying off bills and they are trying to save money. That will weigh on the economy as the government’s stimulus runs its course. People are reaching the end of their unemployment compensation (unless the government extends again) and severance packages are running out. Furthermore, the average baby boomer has less than $80,000 saved for retirement and they need to catch up quickly. Consumption drives 70% of our economy and it will stall in coming months.

Corporations might be hiring people, but they are doing so cautiously. They like the productivity gains and they don't want to add overhead. State and local governments will be laying people off. They have to dramatically reduce expenses to balance their budgets. They are required by the US Constitution to do so. In the next month, the government will hire census workers and that will help temporarily.

The market looks good today and no one wants to short it going into the weekend. The momentum is strong and "Merger Monday" could produce another takeover. We are likely to grind higher. Take very small call positions and be ready to take profits. Tech and retail are leading the way. Stick with those sectors and keep the number of positions small so that you can quickly get out.

The old adage, "sell in May and go away" could hold true this year. That timing would coincide with all of the PIIGS bond auctions. Always be ready to buy puts on a breakdown below SPY 115.

.

.

.

.

We have been trying to spend our way out of every recession and that approach has run its course. In two years, tax revenues will barely cover mandatory expenses (interest on our national debt and entitlement). All the additional essential expenses ($1.4 trillion) will push us further into debt each year.

The market is likely to focus on good earnings, solid balance sheets, mergers and acquisitions, low interest rates and decent economic releases. Next week, we will get many economic releases. They include personal income, consumer confidence, the ADP employment index, Chicago PMI, factory orders, initial claims, construction spending, ISM manufacturing, and the Unemployment Report. This morning, GDP came in as expected and the market liked the number. Many analysts are calling for major job growth in next week's number and the consensus estimates are for 200,000 new jobs. I have even heard estimates above 300,000. That would be great news. It will cause upward pressure on interest rates, but as I mentioned earlier this would be a good reason for them to move higher.

Higher interest rates will also greatly increase our nation’s interest expense. We have an average maturity of 4 years and we will continually be rolling our debt over. The GDP (tax revenues) will have to rise considerably to offset this increase.

I still feel that Americans are paying off bills and they are trying to save money. That will weigh on the economy as the government’s stimulus runs its course. People are reaching the end of their unemployment compensation (unless the government extends again) and severance packages are running out. Furthermore, the average baby boomer has less than $80,000 saved for retirement and they need to catch up quickly. Consumption drives 70% of our economy and it will stall in coming months.

Corporations might be hiring people, but they are doing so cautiously. They like the productivity gains and they don't want to add overhead. State and local governments will be laying people off. They have to dramatically reduce expenses to balance their budgets. They are required by the US Constitution to do so. In the next month, the government will hire census workers and that will help temporarily.

The market looks good today and no one wants to short it going into the weekend. The momentum is strong and "Merger Monday" could produce another takeover. We are likely to grind higher. Take very small call positions and be ready to take profits. Tech and retail are leading the way. Stick with those sectors and keep the number of positions small so that you can quickly get out.

The old adage, "sell in May and go away" could hold true this year. That timing would coincide with all of the PIIGS bond auctions. Always be ready to buy puts on a breakdown below SPY 115.

.

.

.

.

We have been trying to spend our way out of every recession and that approach has run its course. In two years, tax revenues will barely cover mandatory expenses (interest on our national debt and entitlement). All the additional essential expenses ($1.4 trillion) will push us further into debt each year.

The market is likely to focus on good earnings, solid balance sheets, mergers and acquisitions, low interest rates and decent economic releases. Next week, we will get many economic releases. They include personal income, consumer confidence, the ADP employment index, Chicago PMI, factory orders, initial claims, construction spending, ISM manufacturing, and the Unemployment Report. This morning, GDP came in as expected and the market liked the number. Many analysts are calling for major job growth in next week's number and the consensus estimates are for 200,000 new jobs. I have even heard estimates above 300,000. That would be great news. It will cause upward pressure on interest rates, but as I mentioned earlier this would be a good reason for them to move higher.

Higher interest rates will also greatly increase our nation’s interest expense. We have an average maturity of 4 years and we will continually be rolling our debt over. The GDP (tax revenues) will have to rise considerably to offset this increase.

I still feel that Americans are paying off bills and they are trying to save money. That will weigh on the economy as the government’s stimulus runs its course. People are reaching the end of their unemployment compensation (unless the government extends again) and severance packages are running out. Furthermore, the average baby boomer has less than $80,000 saved for retirement and they need to catch up quickly. Consumption drives 70% of our economy and it will stall in coming months.

Corporations might be hiring people, but they are doing so cautiously. They like the productivity gains and they don't want to add overhead. State and local governments will be laying people off. They have to dramatically reduce expenses to balance their budgets. They are required by the US Constitution to do so. In the next month, the government will hire census workers and that will help temporarily.

The market looks good today and no one wants to short it going into the weekend. The momentum is strong and "Merger Monday" could produce another takeover. We are likely to grind higher. Take very small call positions and be ready to take profits. Tech and retail are leading the way. Stick with those sectors and keep the number of positions small so that you can quickly get out.

The old adage, "sell in May and go away" could hold true this year. That timing would coincide with all of the PIIGS bond auctions. Always be ready to buy puts on a breakdown below SPY 115.

.

.

.

.

We have been trying to spend our way out of every recession and that approach has run its course. In two years, tax revenues will barely cover mandatory expenses (interest on our national debt and entitlement). All the additional essential expenses ($1.4 trillion) will push us further into debt each year.

The market is likely to focus on good earnings, solid balance sheets, mergers and acquisitions, low interest rates and decent economic releases. Next week, we will get many economic releases. They include personal income, consumer confidence, the ADP employment index, Chicago PMI, factory orders, initial claims, construction spending, ISM manufacturing, and the Unemployment Report. This morning, GDP came in as expected and the market liked the number. Many analysts are calling for major job growth in next week's number and the consensus estimates are for 200,000 new jobs. I have even heard estimates above 300,000. That would be great news. It will cause upward pressure on interest rates, but as I mentioned earlier this would be a good reason for them to move higher.

Higher interest rates will also greatly increase our nation’s interest expense. We have an average maturity of 4 years and we will continually be rolling our debt over. The GDP (tax revenues) will have to rise considerably to offset this increase.

I still feel that Americans are paying off bills and they are trying to save money. That will weigh on the economy as the government’s stimulus runs its course. People are reaching the end of their unemployment compensation (unless the government extends again) and severance packages are running out. Furthermore, the average baby boomer has less than $80,000 saved for retirement and they need to catch up quickly. Consumption drives 70% of our economy and it will stall in coming months.

Corporations might be hiring people, but they are doing so cautiously. They like the productivity gains and they don't want to add overhead. State and local governments will be laying people off. They have to dramatically reduce expenses to balance their budgets. They are required by the US Constitution to do so. In the next month, the government will hire census workers and that will help temporarily.

The market looks good today and no one wants to short it going into the weekend. The momentum is strong and "Merger Monday" could produce another takeover. We are likely to grind higher. Take very small call positions and be ready to take profits. Tech and retail are leading the way. Stick with those sectors and keep the number of positions small so that you can quickly get out.

The old adage, "sell in May and go away" could hold true this year. That timing would coincide with all of the PIIGS bond auctions. Always be ready to buy puts on a breakdown below SPY 115.

.

.Daily Bulletin Continues...