Quick Rebound Indicates Market Strength – Watch For Stocks That Sell Off After Great Earnings!

Typically, we see nice moves during the first two weeks of earnings season. This is when most of the surprises occur. Stocks in the various sectors react to early releases and guidance. So far, we have not seen much movement.

Over two thirds of the companies have beaten revenue estimates and 80% of companies have beaten earnings expectations. Stocks are priced for good earnings and companies have delivered. However, they have not knocked the cover off of the ball.

Last Friday, we finally saw some selling. In two short days, the market has been able to recover most of those losses. Part of the decline resulted from the "surprise component" of the Goldman Sachs fraud suit and the rest of it was due to option expiration. Once the momentum was established, traders had to adjust positions and the selling accelerated.

After reviewing the news over the weekend, the market stabilized Monday. The market’s upward momentum is strong and it will take a series of bearish news events to topple it. We are likely to see traders take profits after earnings are released, but don’t expect a major decline. There will be some selling pressure on the market for a few weeks, but it will recover towards the end of earnings season. This pattern happened in November and February.

The earnings releases are very heavy this week. Apple will announce results after the close. It has been a great performer and they will not disappoint. That does not mean the stock will go up. It has been in a major rally and the news is priced in.

I suggest monitoring strong stocks that have released excellent results and pull back on the news. Once the market finds its footing, these will be excellent put credit spread candidates.

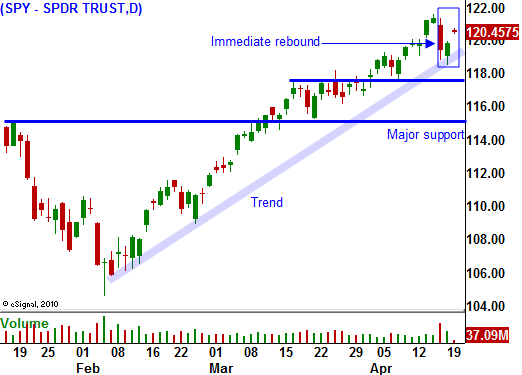

I believe the market will be pressured during the next few weeks, but I expect SPY 115 to hold. This will be nothing more than technical selling. From a fundamental standpoint, the credit crisis in Europe needs to worsen or a trend of deteriorating economic statistics needs to unfold before a sustained decline can take place.

The economic news this week is also light and it will not provide any fireworks. The PPI should be benign and inflation is not a concern. Initial claims will be closely watched. Jobs are not growing at the expected pace and the release has been negative the prior two weeks. Analysts blamed this on seasonal adjustments and we will see if that is true this week. On Friday, durable goods orders will be released. That number is very volatile month-to-month and traders react to it, but they take it in stride.

The price action has stabilized and the market feels like it will trade within a narrow range. The easy money has been made and now it will be important to trade individual stocks. Watch for sector rotation and take advantage of those moves. The top candidates in the Live Update Table will show you which groups are getting the most action.

Monitor earnings releases and wait patiently for put credit spreading opportunities. I am not expecting this anytime soon, but always be ready to buy puts if the SPY closes below 115.

Daily Bulletin Continues...