Look For Weakness Into Friday and Support At SPY 115.

Yesterday, the market tanked on fears that the Greek credit crisis would spread. Interest rates in Portugal and Spain have started to creep higher. Portugal held a bond auction this week and the bid to cover was 1.9. Just two weeks ago, it was almost 4.0. That shows that demand is weakening. Rumors have circulated that Portugal's debt rating is likely to be cut. Spain will hold a major bond auction this week and traders will be watching the results very closely.

Even though Greece is likely to secure aid, its citizens are rioting. They do not like the austerity measures that will be imposed. This sends an alarming message to EU members as each of them votes on the bailout.

The major wealth centers of the world have astronomical debt levels and they have painted themselves into a corner. Even aid for a small country like Greece has been painstaking to arrange. Imagine the hardship when a larger nation like Spain asks for help. It has been coined "too large to bail". This credit crisis will continue to grow and each country will eventually fend for itself.

During the next few weeks, we are likely to see weakness. Asset Managers are not eager to chase stocks. At these levels they do not feel as though they will miss the next big rally. Earnings are more than half over, seasonality is weak (sell in May and go away), and the PIIGS auctions will heat up. They would just as soon see how things play out. Once support is established, they will start to bid for stocks.

Fantastic earnings and low interest rates will support the market while economic conditions deteriorate and credit issues build. This die-hard market will be hard to turn, but it will falter by late summer.

The economic numbers this morning were decent, but not great. The ADP employment index showed 30,000 new jobs in the private sector. That was slightly better than expected, but it was not a great number. ISM services came in at 55.4. That is a strong number, but it is below estimates.

Initial jobless claims have been dismal the last four weeks. This could produce a "soft" Unemployment Report on Friday. Analysts are expecting 180,000 new jobs. Surprisingly, if jobs grow at a slower pace than expected, the market might rally. It would keep the Fed at bay and interest rates would likely remain low. Bulls would embrace this "not too hot, not too cold" scenario. That mentality will work for a while, but if job growth slows and the unemployment rate creeps higher, the market will fall after two or three consecutive misses. Unless we see job losses (unlikely), Friday’s number is likely to generate a good market reaction.

The only "fly in the ointment" is the credit crisis at this juncture. European bond auctions are likely to go poorly and credit ratings will be downgraded. I am expecting another down leg and we should see weakness into Friday's number. Heading into the weekend, fear will subside and prices will stabilize next week. I believe SPY 115 will hold this week.

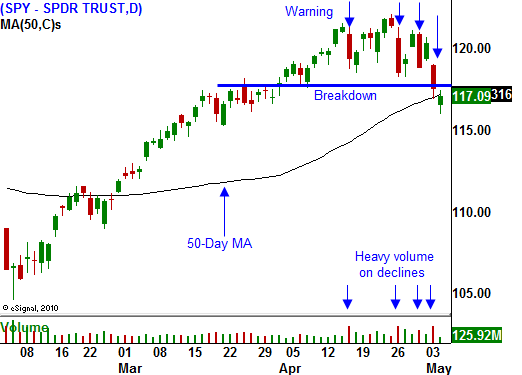

Bullish speculation has been extreme and these players need to be flushed out. The market dropped quickly this morning and the snap back rally will attract "dip buyers". This strategy has worked well recently, but I don't believe it will work today. We have seen huge volume on major declines and the warning signs are there. Once today's rally loses its momentum, I believe we will see weakness into the close.

Greece is getting all of the headline news, but don't forget China's PMI came in weak yesterday. Furthermore, purchasing prices rose 7.5% from March and inflation is a major concern. Earlier in the week, China raised bank reserve requirements and they are trying to slam on the brakes. The entire world is counting on Asian growth.

Be ready to take profits on put positions during the next down leg. I suggest scaling out since you won't be able to pick the exact bottom. Resistance is building and you can sell call credit spreads into failed rallies.

Daily Bulletin Continues...