Fear Has Pushed The Market Down To Critical Support At SPY 115!

The market continues to trade lower on Euro credit crisis concerns. The IMF and EU are bailing out the country and citizens are rioting because they want to keep milking the system. Unfortunately, this cow has run dry and massive austerity programs will be imposed. The violent reaction concerns every nation that will participate in the bailout.

As a member of the IMF, the US (taxpayers) will also be providing $8 billion of aid. At a time when we have our own massive deficits, lending money to ungrateful socialists makes me ill. Europeans feel the same way and the bailout is unpopular. This whole episode reminds me of an experience I had years ago in Chicago. I was walking down the street and I gave a panhandler $5 dollar bill. He looked at it and started yelling at me saying that it wasn't enough. In an instant, my compassion turned to anger. Greek citizens had better straighten up or they will lose tourism revenues.

If the wealth centers of the world can't even bail out one little country without major turmoil, what will happen when Portugal and Spain come knocking? Their interest rates are creeping higher and they will be the next casualties. Portugal held a bond auction early this week and the bid to cover with half his big as it was two weeks ago. That means the demand is drying up. Spain held a five-year bond auction and the bid to cover was 2.4. That was a decent showing, but it was not particularly strong.

Elections are taking place in England and three candidates are running neck-and-neck. Those results will be known before tomorrow's open. The results will influence trading and if conservatives win, it will mean that deficits will be reduced. That would be bullish.

Each EU member will be voting on whether or not to provide aid to Greece. Those outcomes will be known over the weekend. Germany is the kingpin to the entire process since it is the largest (and most able) member. Once their decision is made public, other nations will fall into place.

I believe that Greece will get its aid, but the celebration will be short lived. Traders are already eyeing up the next target and they know that a little push can add to elevated levels of fear.

The credit crisis in Europe will continue to grow for months, but I believe that the market will find support next week. We are not close enough to a default and the problem is not widespread enough. Earnings have been fantastic and interest rates are low. Tomorrow's Unemployment Report should be positive for the market and we could see a rally heading into the weekend. The Euro has plunged against the dollar and it is so oversold that a short covering rally is due.

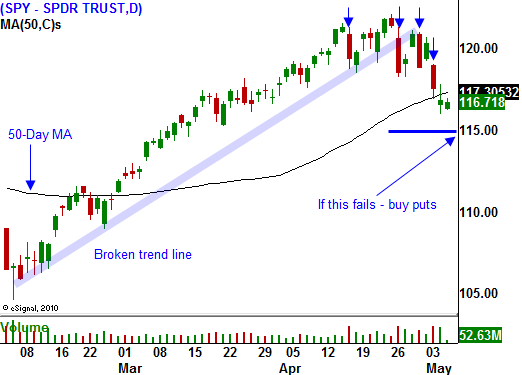

The market is testing a major support level at SPY 115. A breakdown would be very negative since it would violate the one year uptrend and horizontal support. I would not add to short positions today if the SPY closes below 115. There are too many news items coming out before tomorrow's open and worst-case scenarios are already being priced in.

I've been advising you to get short this week. We have easily drifted down to this level and that is a bearish sign. We should continue to see selling into the close today. I suggest taking partial profits ahead of overnight news. You can always take new bearish positions next week if the market continues to slide.

From this point on, you can short failed rallies.

Daily Bulletin Continues...