Fear Spreads Quickly As Investors Are Rminded Of Last Year’s Financial Crisis!

It's funny how the character of the market can change overnight. A few weeks ago, you could throw any bad news you wanted at it and traders would completely discount it. In the last five days, fear has resurfaced and many good news releases have not calmed nerves.

Earlier in the week, ISM manufacturing and ISM services came in very strong. Both signaled that economic expansion is underway. This morning, the Unemployment Report showed that 290,000 jobs were created in April. That was much stronger than expected. For the first time in many months, private sector job growth was strong.

Greece has been in the spotlight and many EU countries voted to bail them out. Germany was the most important player and they quickly stepped up to the plate.

In England, conservatives won the elections. This means that balancing the budget will be a priority. Given that the recent meltdown in global markets is credit related, this news should have come as a relief.

With all of this good news, you would have expected a big rally. The S&P 500 traded higher on the open and gains quickly turned into losses. The futures contract was down 25 points in early trading. The market has finally realized that astronomical debt levels around pose great risk.

It is always hard to gauge fear. A year ago, people were buying safes and guns. We know this because those companies posted fantastic earnings when everything else was falling apart. The threat of a financial collapse was very real. As the economy recovered, investors distanced themselves from those thoughts.

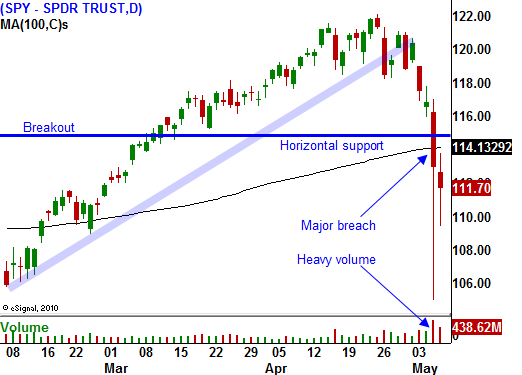

Yesterday, panic set in and traders remembered that empty feeling from a year ago when their portfolios tanked. Many investors took profits and the selling pressure breached major support at SPY 115. Once that level was broken, a sea of stop orders were triggered. Electronic exchanges could not keep up with the order flow and chaos set in. For a moment, the bottom fell out and the Dow was down 1000 points.

I am long-term bearish and no matter what politicians and analysts say, Europe will be a problem. For that matter, Japan and the US have massive debt levels and they will also be a problem. Once enough countries start asking for aid, investors will quickly realize that there is not enough money to go around. Each country will have to fend for itself.

I don't believe we have reached a breaking point yet. This time frame reminds me of 2007. During the summer and into fall, the market staged two swift, deep declines on worries of a "housing bubble". The dust quickly settled and those theories were quickly abandoned when there weren't any casualties. In both instances, the market rebounded quickly. In fact, the S&P 500 made a new all-time high in October 2007.

This market is likely to do the same. Fear levels are high, but there aren't any failures yet. Earnings have been fantastic, balance sheets are strong and interest rates are low. Once this wave of selling runs its course, stocks will rebound. Credit worries in Europe will fade for a few weeks. Option implied volatilities are high and they will drop to the low 20s. Fear is a little ahead of itself.

There is one major difference between 2010 and 2007. Three years ago, the market had been in a five-year rally and the thought of a financial collapse was preposterous. The memories from a year ago are vivid and fear could accelerate much faster than it has in the past.

In the early going, investors will error on the side of safety and they will get out of stocks. I believe we will see selling into the close and perhaps early next week. European bonds yields will be the key. If the crisis spreads to Spain, it is all over. I would not be surprised if the IMF steps in to secretly support Spain’s bond market.

If you have short positions, take some profits on the big dips. That will make your remaining position much easier to manage. If you do not have short positions, I would wait for a better entry point. I believe you will get your chance in a few days. Plus, you will have the opportunity to see which “dogs” don’t participate in the rebound. Those will be your best shorts.

Daily Bulletin Continues...