EU Funds A $1 Trillion Aid Package – Massive Eurodollar Short Covering Sparks Rally!

I am posting market comments early due to a massive overnight rally in Europe.

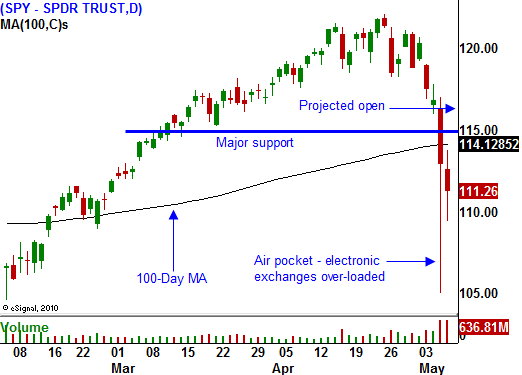

Last week, fears of a European credit crisis slammed the market. Investors fled for the exits and the market hit an air pocket when it broke below SPY 115. That was a major support level and stop orders triggered an intraday 1000 point drop in the Dow. The selling continued Friday even after a round of good news.

ISM manufacturing and ISM services showed strong economic growth earlier in the week. The, Unemployment Report revealed that 290,000 new jobs were created in April. That was 100,000 more than analysts had expected and the private sector accounted for a nice portion of the growth. In Europe, the EU (and each of the member countries) had approved a bailout for Greece. This should have calmed nerves, but it didn't. Conservatives won elections in England and that should have also eased fear since they are committed to balancing the budget. Traders did not want to go home long and they sold into Friday's close.

In last Friday's comments I urged traders to take profits on short positions. I've seen these situations play out and I knew that it was too early for a full-blown meltdown. In order for the market to freefall, we need to see actual failures. Right now, the sharks are circling, but they have not drawn blood.

Greece had barely secured aid when traders set their sights on the next victim. Interest rates in Portugal and Spain started edging higher and rating agencies had downgraded their debt. Bond auctions in these two countries went poorly and the cost of capital was on the rise. Investors worried that the entire EU would quickly collapse and that the credit crisis spread.

Over the weekend, the EU took proactive steps and they put together a $1 trillion emergency rescue package. They will provide monetary aid to struggling members if they adhere to new debt guidelines. The Eurodollar had been crushed in recent weeks and that trade was over-crowded. A massive round of short covering has taken place and the S&P 500 is trading 51 points higher (pre-open).

This morning, we will see massive short covering. For the time being, traders will focus on strong earnings releases, low interest rates and stability in Europe. It won't take long for that euphoria to fade.

The underlying problems still exist. Governments spend more than they generate in revenues and that won't change. In Greece, riots broke out when austerity programs were imposed and that will play out in other counties as well. Here in the United States, Republicans want to keep taxes low and Democrats want to keep spending at current levels. Both parties are unwilling to compromise and our nation will continue to slip further into debt. The PIIGS will continue down this slippery slope and $1 trillion won't stretch very far.

Just as we saw in the US last year, the EU will go down swinging. They are trying to get ahead of the curve (although they never will) and they have dragged their feet too long. When one small member like Greece can rattle the entire system, the strength of the EU is questioned. This move over the weekend will restore some confidence and in coming months, we can expect them to throw the kitchen sink at the problem.

Both Spain and Portugal had to contribute to the Greek bailout. This is comical since both counties will soon be asking for aid of their own. Italy, Ireland and England are also on the ropes and this is a case where bankrupt countries are bailing each other out. It won’t take long for traders to realize that this game of musical chairs will end soon.

Last week I referenced the price action in 2007. I mentioned that in coming months we would see a series of steep declines followed by sharp rebounds. In 2007, analysts forecasted a "housing bubble" and a few times, fear caused the market to plunge. When the dust settled and there weren't any casualties, the market would spring back. It wasn't until we had actual "dead bodies" (IndyMac, Countywide) that the market staged a sustained decline.

This is exactly the type of price action I expect during the next year. Conditions will deteriorate but some last-ditch effort will save the day. Eventually, the problem will become too big and traders will realize that defaults are inevitable.

This morning we will see one of the biggest short covering rallies I’ve ever witnessed. I believe it will run its course over a period of days and stall.

Printing money will postpone the crisis. If countries continue to run deficits, we will reach a breaking point and the financial system will collapse in a few years. Real cuts and tax increases are needed to solve the problem. If they are instituted, they will have a negative immediate effect on consumption and the economies will contract. Either way there will be pain.

If austerity programs are implemented and taxes are raised, economic activity will shrink. It would take decades of saving for us to work our way out of this mess and I do not see it happening.

In the US, we have had 4 years where we ran a budget surplus in the last 40 years. At its best level (1999) we generated $225 billion in surplus. I’m sorry to say, that is chump change by today’s standard of spending. In the EU, it is an even more daunting task since each country has its own political structure.

We have been on the same road for 40 years and there is no reason to believe that we can get off. I believe that Europe and the US will continue to try and spend their way out and that we are headed for a major financial collapse in a few years.

Look for a rebound and some follow through. I am expecting the highs of SPY 121 to hold for many months. I will be selling out of the money call credit spreads once the rally stalls. Fear has returned and this bailout will temporarily calm nerves, but it will not restore confidence.

Watch the bearish stocks in the Live Update table. Focus on those that spring back because they have been pounded. Once they hit a brick wall, you can consider shorting them again.

Daily Bulletin Continues...