History Tells Us That Promises Of Austerity Will Be Hard To Keep – Watch For Resistance!

In the last week, the Euro credit crisis has finally received the attention it deserves. For months, investors did not know where the EU stood. Over the weekend, the EU got ahead of the curve by committing to a $1 trillion aid program for struggling members.

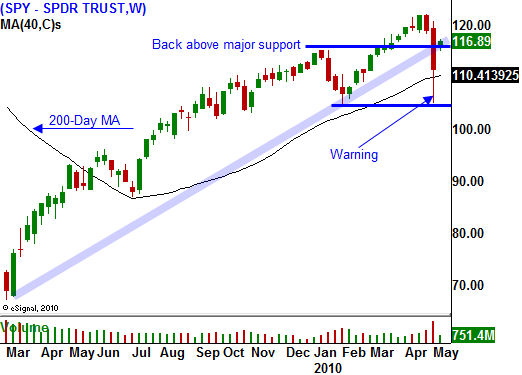

The market staged one of its biggest one-day rallies on Monday and we have seen follow-through buying this week. Traders want to focus on strong earnings, improving economic conditions and low interest rates. These are powerful forces and many believe that we are in the "sweet spot" for equities. In the process, the market has rallied back above major support at SPY 115.

Nations have shifted their focus from stimulus to fiscal constraint in the last few weeks. Overnight, Spain and Portugal announced austerity programs. In the US, we will use excess TARP funds to pay down debt rather than waste it on another stimulus program. Conservatives won the elections in England and they are committed to a balancing their budget. Unfortunately, issues still loom and the credit crisis will continue to grow.

The $1 trillion program has yet to be funded and it won't be until the need arises. Promises are easy to make, but tough to keep. When countries fail to appropriately reduce spending, others will be reluctant to provide financial support. Germany has already been kicking and screaming throughout the entire process and Prime Minister Merkle is losing popularity among voters. Countries that are in financial trouble themselves will be asked to contribute. They may unwilling or unable to help. Spain and Portugal are contributing to Greece's bailout.

When I looked at Spain's austerity program, they plan to trim government salaries by 5% and freeze them in 2011. They are not going to raise the retirement age from 65 to 67. These measures are miniscule and they will not stop the bleeding. Unions are already preparing to strike. With a 20% unemployment rate, tax revenues are falling quickly. The deficit will continue to grow.

Massive reforms are needed throughout Europe and the United States to balance budgets. Social programs are escalating and they will only get worse as the population ages. Not one nation, including the US has talked about a budget surplus in the next 5 years! They are simply trying to slow down the rate of descent into the abyss.

Let's suppose that politicians make a concerted effort to reduce debt. Taxes will increase dramatically and spending cuts will reduce health care and retirement benefits. American taxpayers account for 80% of revenues and entitlement programs comprise more than 50% of our expenses. Consequently, any action that does not take these measures will not meaningfully reduce deficits. If taken, these actions will result in an economic contraction since more than two thirds of our GDP comes from consumption.

After decades of overspending, we either tighten our belts like never before or we default. Both outcomes are painful.

China is dependent on exports and a slowdown in the Western Hemisphere will send them into a tailspin. They are expanding at an unsustainable pace and their economy has reached speculative levels. The Chinese government has raised bank reserve requirements for times this year and only citizens that do not own property can apply for a mortgage. They are preparing to raise interest rates in an effort to fend off inflation.

The credit crisis will take time to unfold. In coming months, we will see that much of the rhetoric in the last week has been lip service. When the heat is on, politicians will tell you what you want to hear. Countries will not be able to control debt and fear will return. When it does, the market will ignore promises and it will realize that the credit crisis has reached the point of no return.

Germany does not want to bail out Greece anymore than I want to bail out my neighbor who bought more house than they could afford. Those who are fiscally responsible will look for reasons to renege on their promises. Citizens that will be affected by budget cuts will riot and there will be civil unrest.

The warning shot that was fired last week needs to be respected. The market was already starting to line up its victims (PIIGS) and that pressure has temporarily been lifted. The sharks are circling and they know that major nations are perilously close to the edge of the cliff. A nudge in the right direction could start a chain reaction.

I believe the highs for the year are in. Austerity programs will stifle economic growth and resistance levels should hold. Over a period of months, conditions will deteriorate and the market will ignore future promises.

If the EU/IMF is serious, they need to force members to fund the $1 trillion program right now. In reality, no one has that kind of money (and traders know it). The US is still trying to raise money for its own $1.5 trillion deficit for 2010 and it will auction $23 billion 10-year bonds today.

This rally still has some steam left in it. The drop last week was dramatic and bargain hunters still have some firepower. When the upward momentum stalls, I will be selling out of the money call credit spreads. I sold a few yesterday and I will sell a few more today. My total risk exposure at the end of the week should be 25% of my capital. I will add to positions if the market can not advance.

I am not buying puts until the SPY closes below 115. That is critical support and if it fails again, the next wave of selling will be sustained. Late day selling is a bearish sign. Pay particular attention to the price action in the last hour of trading. If we pull back, sell some call credit spreads.

Daily Bulletin Continues...