Stay Short Until You See A Huge Intraday Reversal Off Of A Horrifying Low!

Today, heavy selling has set in. Decliners outnumber advancers by a margin of 25:1.

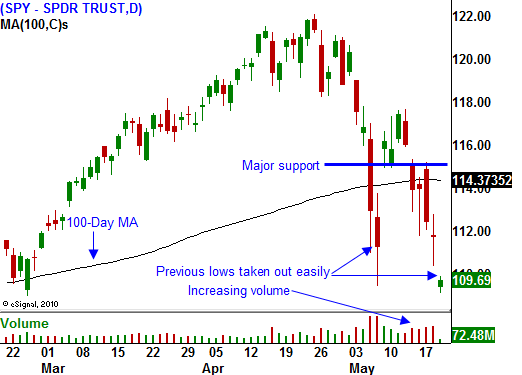

When the market transitions from a bullish trend, buyers bid for stocks as long as major technical support levels hold. Once that support is breached, they put their wallets back in their pockets. Now, we have reached that stage.

The Euro crisis has sparked fear and traders believe that default is imminent. Massive debt levels across Europe have painted countries into a corner and capital will be tough to raise.

With their backs against the wall, the EU will try anything to stay unified. Unfortunately, the $1 trillion "slush fund" did little to calm nerves. Germany's short-selling restrictions backfired and European stocks are in a freefall. The market believes that the EU is helpless.

China's market is making new 52 week lows. Remember, this is the country that is supposed to save the world from an economic collapse. It has exposure in Europe. More than half of China's GDP comes from exports and the EU is a huge consumer (25%). Their economy has reached speculative levels and the Chinese government is trying to pull back the reins. When current commercial construction projects are completed, there will be 30 billion square feet of office space. Every man, woman and child in China can have their own 5 x 5 cubicle. Inventories have been replenished assuming that a full-blown global recovery was underway. I believe China will be sitting on a glut of inventory as demand subsides.

In the US, jobs have been slow to recover. This morning, initial jobless claims rose to 471,000. That was much higher than expected and the four-week moving average is climbing. Corporations will not be adding staff during times of uncertainty. Government stimulus has run his course and I am expecting higher unemployment in coming months.

Banks are still straddled with toxic assets. A double dip recession would be devastating, but we could deal with that. However, if a European credit crisis unfolds, the entire banking system is likely to freeze up just as it did a year ago.

Major technical support levels have fallen and fear is back in the marketplace. Investors do not want to relive the horror from a year ago and they are heading for the sidelines. Fear is almost impossible to gauge or predict. History tells us that fear causes markets to fall farther than anyone could have imagined.

We are in the early stages of this decline. I believe that in the next day or two we will see a huge intraday reversal off of the lows. That move will establish a support level and we will see a short covering rally. This selloff has gotten a little ahead of itself.

Profits are fantastic (although they will be pressured in future months), balance sheets are strong and interest rates are low. These forces will attract buyers in the early stages. As of yet, we do not have a sovereign default in Europe. Countries are dangerously close, but bonds yields have not jumped - yet. Buyers will try to bargain hunt, but that will end when they get their fingers slammed in the door a few times.

Watch for a dramatic intraday decline and a swift reversal. That will be your signal to take profits on put positions. If you are an active trader, you can sell put premium on strong stocks when that happens. The implied volatilities have jumped and there is a decent edge in this trade. Stock selection is critical, stick with bullish stocks that are rising to the top of the Live Update table. For most of you, don't attempt this strategy. Simply wait for the rally to stall and start buying puts again.

During this rally, start considering long-term (4 to 6 months) out of the money put positions. Once sustained selling sets in, stocks are likely to drift lower over many months. There will be air pockets along the way with big declines. These long-term out of the money positions will give you staying power and you will be able to weather the volatility.

Conditions have turned ugly and we have seen the highs for the year.

Daily Bulletin Continues...