The Market Has Found Support. Take Profits On Bearish Trades!

After a couple of weeks of heavy selling, the market has pulled back 13% from its highs. The first signs of support appeared Friday when the market was able to stage a late day rally.

This morning, prices are stable and the market has gradually tried to claw its way back into positive territory. Over the weekend, Germany announced a $13 billion austerity program. These cuts will last through 2015 and the largest EU member wants to set the example.

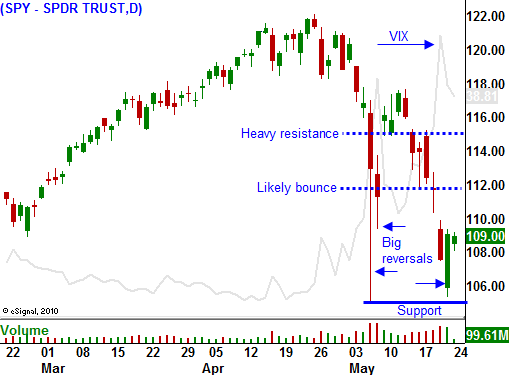

In today's chart, you can see the large intraday drops and the sharp reversals. Buyers are willing to "nibble" at SPY 106 and that level represents short-term support. The VIX has spiked and option premiums are "rich". Conditions have not deteriorated to the point where we will see a crash and I am expecting a snap-back rally. End of month fund buying will start showing up in a few days and that should support the market.

Strong earnings, solid balance sheets, low interest rates and decent economic releases will keep a bid to the market. Conditions in Europe are dire, but a sovereign default is still months away. The EU will try to get ahead of the curve and reform promises will temporarily calm nerves.

A slowdown in Europe will impact China. However, their growth is still strong and bulls are still clinging on to the global expansion theory. The Chinese stock market is down 20% from its high and lofty valuations (not an economic contraction) have been an issue for many months.

There will be a number of economic releases this week, but they should not be huge market drivers. Consumer confidence, durable goods, new home sales, Q2 GDP, initial claims, PCE, Chicago PMI and consumer confidence will be released. Out of all of these numbers, initial claims could have the biggest impact. Last week, they rose to 471,000 and that was much higher than expected. The four-week moving average is increasing and that could be pointing to a double dip recession.

Companies have been slow to rehire and that will continue. Over 25% of the earnings for S&P 500 companies come from Europe. Corporations don't want to add to overhead until they see how things play out across the pond. I believe the unemployment rate will start to climb by mid-summer.

After all of the fireworks last week, the market is due for a breather. A three-day weekend approaches and trading volumes will decline towards the end of the week. As the market finds support, option implied volatilities will decline. Traders will square up positions and wait for major economic releases after Memorial Day.

ISM manufacturing, ISM services and the Unemployment Report will be released after this week.

I am long-term bearish and I feel that a sustained market decline is months away. The market has been in a strong rally during the last year and bulls still have fire power. As prices begin to roll over, you can expect to see sharp short covering rallies. Once a series of lower highs have been established, bulls will become much more passive. They will no longer rush in to "buy the dips" and that is when a sustained decline will unfold. This "topping process" will take a few months to develop. By August, I expect to see a great deal of nervousness.

If you are short, take profits. I will be selling out of the money put premium this week on strong stocks. A quick rally will drain option premiums and then I will buy back those puts. I expect to see first resistance at SPY 112. If the market can't get through that level easily, I will start to sell out of the money call credit spreads. If we blow right through that level, I will wait to sell call credit spreads at SPY 115. That is major resistance and I expect it to hold. Over the next few months, I will gradually be buying long-term out of the money puts on cyclical stocks.

Option premiums are lofty. Try to sell some puts and keep your size small.

Daily Bulletin Continues...