Don’t Get Short Yet. Watch For An Intraday Reversal During A Big Rally!

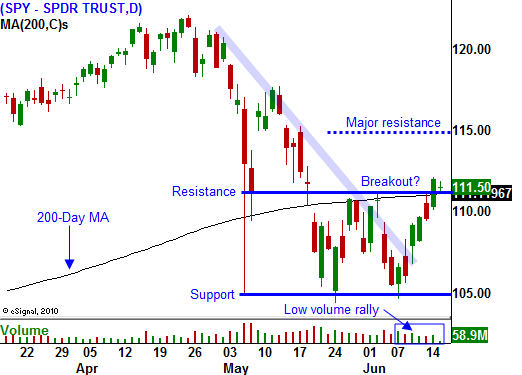

The market has posted four consecutive gains and quadruple witching is pushing prices higher. Once traders saw persistent buying, they legged out of hedged positions and the rally took off. The volume has been relatively light, signaling a low-level of commitment.

This move is nothing more than a technical bounce from an oversold condition. Traders braced themselves for a negative event (failed bond auction, political conflict and evidence of a doubled recession) and it never came. Fear is dissipating and bulls are passively scooping up shares at this level.

I am hoping for a massive rally, but I doubt we won't get one. As the market moves higher, implied volatilities drop and puts become cheaper. This would result in an excellent shorting opportunity.

Major resistance at SPY 115 is the first obstacle and it will probably be tested now that we are back above the 200-day moving average. We are likely to see a round of short covering as option expiration approaches.

The bad news that plagued the market is still looms. Conditions will not deteriorate instantly and more time has to pass before we see a sustained decline. As I have been mentioning, when the market transitions from bullish to bearish, you can expect to see strong snapback rallies in the early stages.

Bulls are still discounting the impact of a slowdown in Europe and they believe that the EU will survive. They continue to focus on good earnings, strong balance sheets and low interest rates. These are powerful influences and they will not die easily.

Overnight, France announced that it is lifting its retirement age from 60 to 62. This seemed like a small step in the right direction until I discovered that it will be phased in over an eight year period. Minuscule little changes like this are merely lip service and won't reduce the huge deficits.

This week, Spain auctioned €5 billion worth of 12-month and 18-month T-bills. The interest rate jumped by 70 basis points and the cost of capital is rising. This is a major warning sign and Spain could be the next problem. Their unemployment rate continues to rise and it is currently over 20%. Keep a close eye on European bond auctions.

Interest rates in Germany are also on the rise. Investors want a higher rate of return since the largest EU member seems willing to backstop everyone else's debt.

The news this week has been light and the rally has been unimpeded. Alcoa will kick off earnings season on July 12 and we are only a few weeks away from those releases. During the last three quarters, the market has been able to move higher ahead of the announcements. We could gradually move higher for the next few weeks.

Once earnings are posted, we are likely to sell-off. This pattern has also repeated itself the last 3 quarters with each decline being more pronounced. Guidance for Q3 will be the key and it might signal a double dip recession.

Don't stand in the way of this market. Let it run until it exhausts itself. I expect to see resistance at SPY 115, but I an intraday reversal during a big rally will be more meaningful than a particular price level. Continued selling the next day will confirm the resistance level.

If initial jobless claims are lower than 460,000 tomorrow, the market is likely to push higher. This number is the only potential spoiler this week and even if jobless claims come in high, the market might be able to overcome it. Early weakness this morning was quickly erased. We have been seeing late day buying this week and that is a short-term bullish pattern.

Be patient and don't get caught up in this rally. Cheer the market on knowing that you will be able to load up on cheap puts, but don't go long. The rug can get pulled out from under you at any time. Resist temptation by remembering all of the potential negative news events and the lingering fear from the recent selloff.

Daily Bulletin Continues...