A Floating Yuan Seen As Bullish – The Market Should Creep Higher Until Earnings Season!

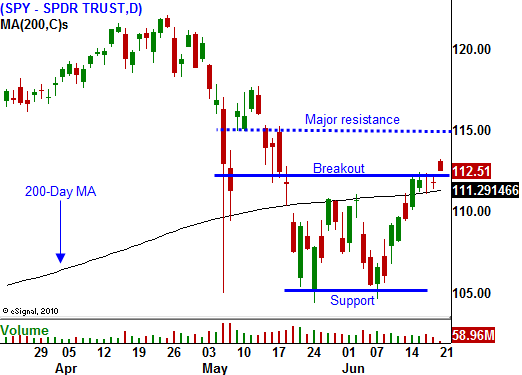

Last week, the market was able to stage a nice rally. It rose above its 200-day moving average and it was able to hold the gains through quadruple witching. The news releases were rather light and buy programs/short covering pushed prices higher.

This morning, China said that it is prepared to let the Yuan float. As it rises in value, US goods will become cheaper on a relative basis and that should boost future exports. The Chinese government did not release any details or timetables.

Global markets rallied on the news, but this decision was largely expected. China has raised its bank reserve requirements many times this year in an effort to slow down its economy. Letting the currency float is another way to put on the brakes.

A stronger Yuan might be good for exports, but it will be inflationary for the US. All of the goods that we import from China will be much more expensive and you can say goodbye to the days of three dollar T-shirts from Wal-Mart. US consumers have benefited greatly from the pegged currency.

The news is rather light this week and the market is likely to grind higher ahead of earnings in a few weeks. That pattern has been strong the last three quarters and it should repeat. Once companies start to announce earnings, the market will decline.

The FOMC statement that will be released Wednesday will not have much of an impact. The Fed will keep its rhetoric the same. Durable goods orders are volatile month-to-month and they will have a very temporary effect. The final revision to first-quarter GDP will also be released and it should not change materially. Initial jobless claims have been weak, but the market ignored a dismal number last Thursday.

The EU is conducting a stress test on its banks and most analysts feel that worst case scenarios are priced in. As a result, European financial stocks have rallied.

We will see to what extend real estate assets have been written down. In any case, a worst case scenario would involve the financial collapse of EU members and there is no way that is priced in. Banks have tremendous investments in sovreign debt and those losses would be massive.

Let the market run and maintain a neutral to slightly bullish bias for the next few weeks. July out of the money puts should expire in good shape this month and I have been selling credit spreads. As we get closer to July expiration, I will start buying longer term out of the money puts. Keep your size small and limit the number of positions.

Daily Bulletin Continues...