It’s Far From Perfect – But It Is The Best – Happy 4th of July!

Yesterday, the market probed for support early in the day. As one initial jobless claims number (472,000) and a light ISM manufacturing number (56.2) sparked selling early in the day. That pressure increased when pending home sales fell by 30%. The S&P 500 futures were down 20 points.

By midmorning, Asset Managers started nibbling and support was established. Beginning of the month fund buying could have been a factor. Given the 11% decline in the last two weeks, the market was due to take a breather. Worst-case scenarios were priced into this morning's Unemployment Report.

Nonfarm payrolls fell by 125,000 in June. That was worse than the 100,000 analysts had expected. The market had a decent reaction to the number because private-sector jobs grew by 80,000. For us to have any chance of avoiding a double dip recession, corporations have to start hiring.

Trading will settle down as the holiday weekend approaches. Option implied volatilities have spiked and they are going to come down as trading activity slows down. The major economic releases are out of the way and they should not be many surprises. The big number next week is ISM services. Private-sector job growth was fairly strong in June (taken from this morning's Unemployment Report) and the number should not have much of a negative impact.

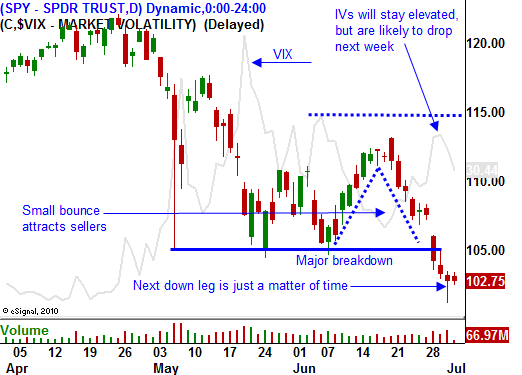

We are clearly below major support and it is just a matter of time until we get the next big selloff. All it will take is one little news item. The PIIGS will be holding bond auctions in coming weeks and a pop in interest rates could be the catalyst. Fear rules the street and investors already have their finger on the sell button.

The market has had a tendency to rally into earnings season. However, this time around, many traders believe that Q3 guidance will be weak and they are selling stocks ahead of time. These two forces should negate each other over the next two weeks.

Time decay and a decline in option implied volatilities is all that concerns bears. They are not worried about a major rally. Any move higher will immediately be met with heavy selling.

If you have front month put options, you might want to sell them and roll out to longer-term positions. By late August (or sooner), I expect to be in a full-blown decline. We are close to the point where bulls will throw in the towel. You don't want to get cute and exit all of your bearish positions. If you do this, you run the risk of missing one of the biggest moves of the year. No one knows when the next big event will hit.

Now that major support has been breached, the snap back rally's be less violent. Maintain bearish positions and consider buying back month out of the money puts. You'll have staying power and you won't have to sweat out the mini rallies. The positions will retain their premium better than short term options.

It is rare to find a person who believes in a cause so completely that they are willing to sacrifice their life for it. Let us remember our founding fathers who risked everything as we celebrate the birth of the greatest nation in the world.

Happy Fourth of July!

Daily Bulletin Continues...