The Recent Rally Was Nothing More Than A Short Covering Bounce!

Friday, the market took a nasty spill and the S&P 500 futures finished 27 points lower. Good performance from the tech sector was overshadowed by major bank stocks. Deteriorating economic statistics also weighed on the market.

Intel posted its best number is 43 years last week. It also provided robust guidance for the rest of the year. AMD also posted solid numbers and the stock tried to rally on the news. CSX said that rail shipments across all segments were strong. Transportation stocks are often used as a gauge of economic activity and normally, the market would have rallied on the news. These earnings started the week off on a good note and it looked like the market would push higher.

Wednesday afternoon, the FED cast a dark cloud over the market. It lowered its GDP estimate for 2010 when it released the FOMC statement on Wednesday. Without question, economic conditions are starting to deteriorate and fears of a double dip recession have surfaced.

That weakness continued Thursday morning, but stocks reversed an early decline when BP said that the oil leak had been capped. The financial reform bill that also passed the Senate and many analysts believed that banks would rally once this matter had been settled. Rumors also circulated Thursday afternoon that the SEC would settle its fraud case with Goldman Sachs (and it did $550 million). Energy stocks and financials pushed the market higher and we finished in positive territory.

The scene changed dramatically Friday morning. Throughout the week, dismal economic releases had been dismissed. Wholesale inventories, retail sales, Philly Fed, Empire Manufacturing Index and consumer sentiment all disappointed.

The economic releases this week are fairly light and that should bode well for the market. The focus should once again be on earnings and this will be a very busy week. After the close, we will hear from IBM and Texas Instruments. These two tech giants should post great numbers. Unfortunately, a number of financial institutions will also be releasing earnings and they are likely to negate any strength in tech stocks. Zions, Goldman Sachs, and State Street will release earnings tomorrow morning. State Street preannounced last week and all of the good news is already built-in. Investment banking and trading revenues were down sharply for J.P. Morgan and Bank of America last week. Goldman will experience the same. The new regulatory reform will hurt profits and I'm expecting Goldman Sachs declined after they release earnings.

Healthcare, biotech, retail, real estate, financials and energy have all struggled. Apart from tech, the market does not have a catalyst. Earnings should be good this week, and I believe the guidance for Q3 will start to slip in coming weeks. That timeline coincides with a heavy economic calendar in the last week of July and the first week of August.

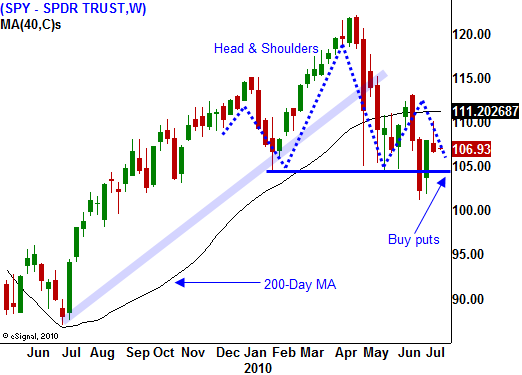

I am expecting a choppy week of trading. There aren't any major European bond auctions this week and I believe the market will be able to hold SPY105. If that level is breached, buy puts.

This morning, Ireland's bond rating was lowered by Moody's. This move was largely expected and Moody's rating is still higher than the Fitch rating. Ireland had to nationalize some of its largest banks and those losses are adding to the country's debt. The market took this news in stride. I have also been keeping an eye on many smaller EU members. Hungary walked away from IMF discussions when officials said that Hungary is not doing enough to cut its deficits. This defiance is not a good sign. Austerity is an ongoing theme throughout Europe and sooner or later, one of these nations (Latvia, Romania, Bulgaria, or Hungary) will fail. That will escalate concerns of a European credit crisis.

For now, I believe the market will chop back and forth. This is a great time to look for relative weakness. Stocks that decline after posting earnings will make great shorting candidates in the next three weeks. If the stock breaks a longer term up trend lines and horizontal support on heavy volume, consider buying puts.

If the market breaks support at SPY 105, get short. That is major support and once we break below it we will quickly test SPY 100.

Daily Bulletin Continues...