If You Don’t Vote – Don’t Complain!

In the next 24 hours, we will know if the market has priced in all of the good news or if the recent momentum still has some gas left in the tank. Election results will carry the most weight and the market's reaction will be known tomorrow morning.

Republicans are expected to win the House and there is a 30% chance that they will also win the Senate. If they exceed expectations, the market will rally. Traders feel that Republicans will reduce regulations and they will support a low tax environment. Cost cutting will be used to balance the budget. If Democrats make a late run and fare better than expected, the market will decline.

Businesses do not want to invest during times of uncertainty. New regulations, the potential for higher taxes and healthcare reform have elevated risk. In 2010, private sector job growth has been minimal and commercial construction continues to decline.

Republicans are not the solution; they will simply slow the bleeding. Politicians on both sides of the aisle continue to kick the can down the road. Entitlement reform (Social Security, Medicare, and Medicaid) is needed immediately. We are already paying out more in Social Security benefits than we bring in. This is six years earlier than expected and it will escalate as baby boomers retire. Everyone will draw benefits ASAP (age 62) fearing that eligibility might be pushed back if they wait until they are 67. This means the burden will be even heavier than expected in coming years.

The government needs to cut expenses, but these savings are miniscule compared to the entitlement vacuum that is sucking the life out of us. Unfortunately, Americans have not saved and they are dependent on Social Security benefits. The average baby boomer has less than $100,000 saved for retirement. Home equity was going to be the "nest egg" that helped to fund retirement. More than half of all homes have less than 10% equity or are under water.

Long-term, I don't like what I see. Our country has been financially "gutted" and now we are reaching for straws. Out national debt has rocketed from $2 trillion in 2000 to $14 trillion 10-years later. We have only run a budget surplus 4 out of the last 40 years. States legalized gambling out of necessity and now they will consider legalizing pot and selling assets. Our Fed will outline their money printing intentions tomorrow and this is supposed to be good news. Clearly, these are acts of desperation.

As I head for the polls today, I am not selecting the best candidate, I am voting for the lesser of two evils. Negative political ads have destroyed credibility and candidates did not offer solutions. They will win by discrediting their opponent.

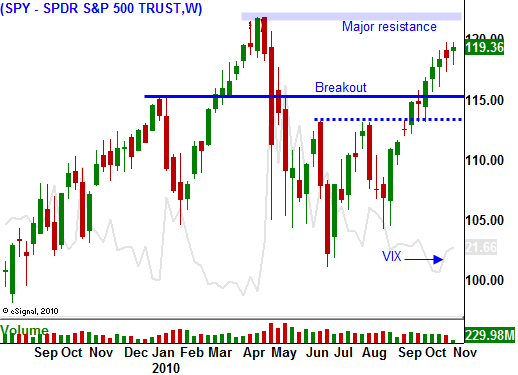

The market will react to the elections tomorrow and it will have a knee jerk reaction to the Fed's QE2. In a matter of days, the dust will settle and traders will see that the landscape has not changed.

Earnings have been good with 85% of companies beating estimates, interest rates are low and China's growth is intact. Any pullback is likely to be brief since Asset Managers want to position themselves for a year-end rally.

Behind the scenes, the foundation will continue to crumble and the credit crisis will continue to grow. Ireland's interest rates jumped higher overnight and credit concerns in Europe will fester. I am short term bullish and long term bearish.

Cash is king. I will watch the price action from the sidelines and I suggest you do the same. In a few days, trading opportunities will present themselves.

Daily Bulletin Continues...