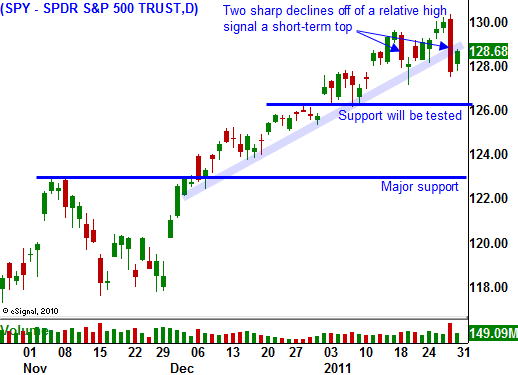

Last Friday’s Decline Was A Warning Sign. Let’s See If Resistance At SPY 130 Holds.

My biggest promotion of the year ends today. Last Wednesday night, I recorded this VIDEO It includes my track record for each service and a look at all of our current trades. Subscribers can get all of my products and services for a year at a deeply discounted price. Click Here to sign up. This is the lowest price of the year and I only offer it once! The special offer ends Monday January 31st. We are off to another great year!

Yesterday, the market was able to recover after Friday's steep decline. Traders realized that protests in Egypt would not disrupt global economic activity. The market was overdue for a correction and this event served as a catalyst. I still believe the downside will get tested this week.

Japan's debt rating was lowered last week by Standard & Poor's. Half of what they spend each year needs to be financed with bond auctions. The situation is dire, but we don't hear about it because Japanese citizens purchase 95% of the debt that is issued. Their personal income fell .4% in December (the first time in 10 months) and that will impact savings. Japan held its first bond auction since the downgrade and the demand was lukewarm. If their interest rates climb just a little bit from the current 1.25% level, a crisis will unfold. Half of their tax revenues (not including bond sales) are used to pay interest expense. If rates rise to 2.5%, they will spend their entire tax revenue paying interest. I am not pulling this out of the air; these numbers come from Japan's Ministry of Finance.

Japan is our second largest bond holder. Imagine what will happen when they are forced to sell US Treasuries to cover expenses. This is the second largest economy in the world and I believe it will be the source of the credit crisis. They have flown under the radar because they buy their own debt. PIIGS countries are getting all of the attention because they rely on everyone else to finance their needs. As a percentage of GDP, Japan's debt is much higher than any of the PIIGS countries.

Credit conditions in Europe have stabilized. For the first time in three months, the ECB did not purchased sovereign debt. The new financing facility has gained widespread acceptance. This is not a solution, it is a temporary fix. Structural issues remain and in time, investors will realize this is a money pit.

This morning, China posted its PMI. It fell to 52.9 versus 53.9 a month ago. This was a market friendly number and analysts expected it to drop even more. China has been raising bank reserve requirements, interest rates and home loan requirements. Many traders speculate that they will hike interest rates before their New Year on February 3rd. I don't believe this will happen. They are seeing signs of a gradual slow down and recent tightening still needs time to run its course.

This will be a busy week for earnings releases, but the focus will shift to economic news. This morning, construction spending declined more than expected, but ISM manufacturing soared. It came in at 60.8, the highest level since 2004. Tomorrow, ADP employment will be released. Last month it surprised analysts when it beat expectations by a huge margin. They process payrolls for small and medium-size businesses. If that number gets revised lower or this month’s number misses expectations (150,000), the market will decline. Initial jobless claims have been creeping higher and employment conditions might not be as robust as we thought.

Corporate earnings have been fantastic. They have grown 35% year-over-year and 75% of companies have exceeded expectations. This will be the driving force behind the next market rally. Stocks are attractively valued and money will shift out of fixed income and into equities as long as credit concerns are suppressed.

Friday's market losses have almost been erased and it looks strong today. I don't believe bullish speculators were flushed out since the decline only lasted one day. They were able to weather the storm and stocks rebounded quickly. Technical resistance is building and there are warning signs. I am looking for a more sustained decline to unfold in the next two weeks. Stocks will gradually drift lower and they will find support at SPY 126 or SPY 123. This is the kind of move that will force bullish speculators out. The move could be caused by the spread of unrest in the Middle East or a dismal jobs report.

Once the selling subsides, an excellent buying opportunity will present itself.

I am looking for call credit spreading opportunities. Restaurant and retail and consumer staples are my favorite areas. You will see many of the stocks near the top of the bearish section of the Live Update table.

Daily Bulletin Continues...