China Raises Interest Rates – Market Takes The News In Stride

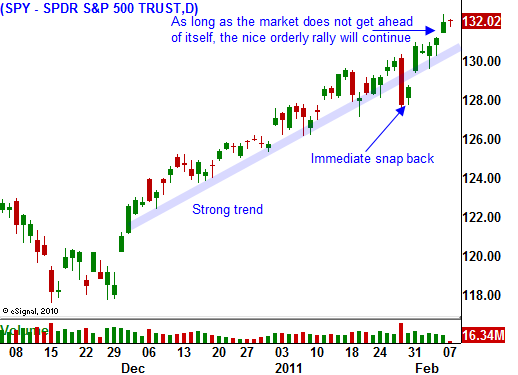

Yesterday, the market pushed ahead and it made another relative high. Late in the day, a small round of profit-taking erased some of the gains. This type of price action is very healthy for the market. As long as the market does not get ahead of itself, we will not see any major declines.

Credit crisis worries have been temporarily pacified. The new credit facility in Europe has restored confidence and PIIGS auctions should go well. Investors realize that if interest rates spike, the countries can buy back bonds and borrow from the new credit facility and a much lower rate. As long as foreign investors support the new Eurobond auctions, credit concerns will be minimal. This is not a long-term solution, just a short-term fix.

The big news today was a quarter-point interest rate hike in China. This is the second one in a month. They have persistently raised bank reserve requirements and that tightening his had little impact. A week ago, their PMI came in at 52.9. That was stronger than expected and the government felt more dramatic action was required. Many analysts have been expecting this rate increase and it has not dampened spirits this morning.

The economic releases this week are light and earnings season is winding down. Trading activity is quiet and the market will be looking for its next catalyst. Asset Managers don't want to chase stocks they will and they will buy dips. That means that support is strong and any decline will be short-lived.

Momentum will gradually carry the market higher. Commodities stocks are pulling back on fear that China's tightening will slow economic growth. These stocks present an excellent buying opportunity. Wait for support.

Look for stocks that have pulled back after releasing excellent earnings. Strong results were priced in and bullish speculators were flushed out. As long as the guidance was good, these stocks will rebound.

Look for the market to grind higher this week.

Daily Bulletin Continues...