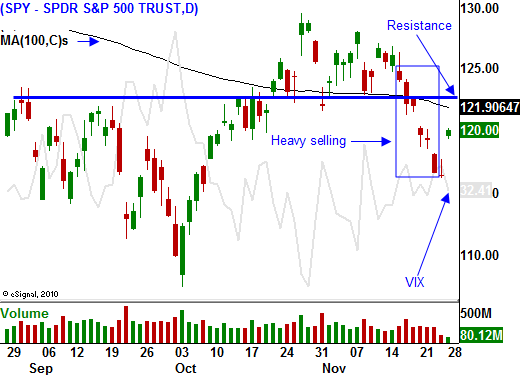

Oversold Bounce Should Stall In the Next Few Days – Stick With Shorts – Place Your Stops

This morning, stocks are rebounding. There were not any concrete developments in Europe and I feel this move is an oversold bounce.

As I've been mentioning, this is a very bullish time of year from a seasonal standpoint and any shred of good news will attract buyers. European officials are trying to accelerate fiscal integration. European authorities would have more power to enforce fiscal discipline under the plan. This effort sparked a 4% rally in Europe and that buying spilled over to our market this morning.

In my opinion, these "sweet nothings" will pacify investors for a few days. Once the momentum stalls, Asset Managers that are eager to reduce risk will sell into strength. That will keep a lid on the market and it will make a lower high.

Moody's warned that European ratings are now at risk because of the rapid escalation in interest rates. It will reposition credit ratings in the first quarter of 2012 and the risk of multiple EuroZone defaults has increased.

Fitch said that it will complete its review of US debt in the next few days. Most analysts expect the ratings agency to lower its outlook to negative. This should not spark a selloff, but it will provide a headwind.

Interest rates throughout Europe are climbing and in many cases (Spain and Italy) they have reached the point of no return. International banks are selling European assets and liquidity is drying up. American money market funds have reduced their exposure to Europe by 9% in the last month and Japan's largest mutual fund sold its debt holdings in Greece Spain and Italy.

Italy will hold a bond auction tomorrow. The last one (two weeks ago) went horribly. France and Spain will auction bonds on Thursday.

The Super Committee was not able to reach a decision and Congress will fight to stop $1.2T in automatic spending cuts. This battle will be waged for months to come. Many US government agencies will run out of money in the next few weeks if budgets are not increased. This issue will start grabbing headlines in the next few days. Congress will also fight over the extension of unemployment benefits and payroll tax credits. They will expire at the end of December and Democrats want to “tax the rich” to for pay for the extensions. Republicans won’t budge and they will demand spending cuts to pay for the programs.

Nothing has really changed over the weekend. The situation in Europe is dire and this round of news lacks substance. The notion of a "grand bargain" pushed stocks higher in October, but traders realized that the plan didn't solve the problem once it was announced. Not one dime has been raised by banks or the EU in recent weeks. China and the US have told Europe that they need to solve their own problem. Entitlement reform is the key and politicians don’t have the “stones” to do it.

From an economic standpoint, GDP declined last week and the flash PMI in Europe and Asia was weak. These releases more than offset any strength in Black Friday retail sales (up 6.6%). Most of the sales have resulted from deep discounts and profit margins will be down.

This will be a busy week for economic releases (Beige Book, ADP employment, Chicago PMI, initial claims, ISM manufacturing, EuroZone PMI, China's PMI and the Unemployment Report). The market seems content with the current economic backdrop. Growth is extremely low, but conditions are stable. Seasonal strength and hope could fuel this rally for another day or two.

The market declined steadily for two weeks taking out major support levels. Fear has returned and investors will be very cautious. They need to see concrete developments in Europe before they commit.

In order to get a sustained rally, we needed to see an air pocket. That capitulation low and an intraday reversal would have provided a buying opportunity and I am not taking bullish positions until I see this price action.

The news is dire and the selling pressure will return. Stocks surged higher after the open and they have flat lined ever since. Once the momentum stalls, sellers will begin to hit bids. If the SPY finishes the day below 118, this rally might have already run its course.

I am long puts and I have lowered my stop to SPY 123. As long as the SPY closes below that level, I will stick with the positions. If the market rallies above that level, I will take profits and move to the sidelines.

My gut tells me that we will see a fairly heavy round of selling this afternoon. The market will still finish in positive territory, but some of the gains will be given back.

Daily Bulletin Continues...