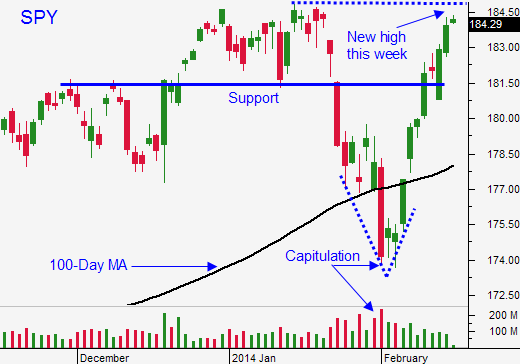

Market Poised To Make A New All-Time High. Momentum Will Take Over Next Week

Wednesday the market hit an air pocket and Asset Managers pulled bids. Once the momentum was established, stocks continued to drift lower. Bulls needed to step in immediately and they did. All of the losses were erased yesterday and we are within striking distance of the all-time high.

The market demonstrated resilience and the bid is strong. As I mentioned yesterday, the market will climb a wall of worry.

Corporate profits grew 7.5% year-over-year, underlying domestic activity looks good given horrible weather conditions, the Fed is willing to pause tapering if this soft patch lingers, the debt ceiling has been extended by a year and Obamacare will be postponed for small businesses. These are all positive influences.

Growth is slowing in China, but Europe is recovering. One should offset the other.

Emerging markets are experiencing currency fluctuations due to tighter credit markets. However, credit issues are quarantined. PIIGS yields remain stable.

China seems to be the "fly in the ointment". Traders are worried about shadow banking and the gradual decline in growth. I'm not overly concerned. China's growth target is 7.8% and the PBOC will step in if conditions deteriorate.

I needed to see the bounce yesterday morning. When stocks started to grind higher, I added to my call positions. My size is small and I will buy more calls if the SPY closes above $185.

The news is light next week. Durable goods orders, GDP and "Fed Speak" are scheduled for Thursday and Friday. That means there won't be anything to impede this rally and momentum will push us to a new all-time high.

Own some calls and add on a breakout.

MEN'S OLYMPIC HOCKEY - GO TEAM USA!

.

.

Daily Bulletin Continues...