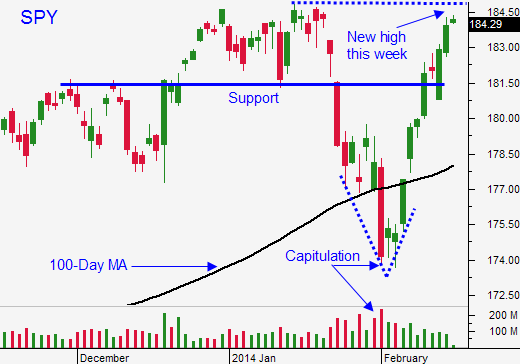

New High – Buy Calls. We Should See Follow Through Buying the Next Two Days

The market is making an all-time high this morning. Stocks pulled back after the FOMC minutes were released last week and they immediately rebounded on Thursday. This price action signaled that buyers are close at hand and I sensed a breakout.

China's flash PMI was weaker than expected last week and this seems to be the "fly in the ointment". Home prices are not growing as fast as they have been and that is concerning for some traders. Personally, I believe the PBOC will step been if conditions deteriorate. They have a growth target of 7.8% for this year and they are below it.

Growth in the EU continues to recover. Flash PMI's were a little light, but growth is still on track. Any sustained rebound will have a global ripple effect. Europe has weighed on the market for years and it could be the next catalyst. This morning, Moody's upgraded Spain's debt.

Domestic flash PMI's were better than expected last week. Initial jobless claims continue to decline and traders are willing to give soft data a free pass because of bad weather.

The economic releases are light this week and that means there is not much to stand in the way of this rally. Durable goods orders will be released Thursday. This is a volatile number and it does not have a lasting impact. GDP will be released on Friday. Consumption has been down and inventories will build as a result. The number should come in a little light, but it won't spoil this rally.

Janet Yellen will testify before Congress on Thursday. She is considered by most to be dovish and her statements should be market friendly.

The debt ceiling has been extended by a year and Obamacare will be pushed back by a year for small businesses. These are major developments and they reduce uncertainty.

Corporate profits have grown at 7.5% year-over-year and that is a healthy pace. Cash flows are at record levels and companies are using that money for M&A and buybacks.

The dividend yield on the S&P 500 is higher than the yield on US 10-year treasuries. That makes stocks attractive relative to bonds.

In the last year the market has breached the 100-day moving average 4 times and it has snapped back. Buyers scooped up stocks and in each instance and that capitulation resulted in a new relative high.

That is happening this morning. We should see sustained buying the next two days.

I bought calls early last week and as described, I added when we rebounded on Thursday. I also mentioned that I would add to positions if the market traded above SPY $185. We have broken through resistance and I am buying calls this morning.

Ideally, the market will continue higher and I will be able to use SPY $185 as my stop. That would guarantee profits on my call positions.

Get long and focus on stocks that are breaking out. We should see a nice follow-through the next two days.

.

.

Daily Bulletin Continues...