Ukrainian Crisis Not Over – Market Does Not Care. Wait For ADP Wed

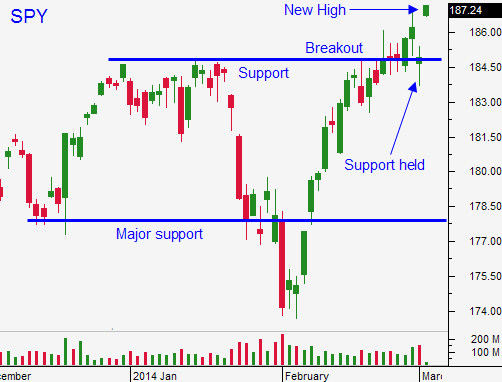

Yesterday, the market sold off when Russian troops entered Crimea. Tensions eased overnight and the S&P futures are up 20 points before the open. If the gains hold, the market will make a new all-time high.

The Ukrainian crisis is far from over, but the market might not care. Putin ordered his troops back to base. A parasite does not want to kill its host. It wants to go undetected as long as possible and gradually grow. This is the game plan and Russia will not give up this strategic open port.

The strategy will work. Obama does not want another conflict and Europe does not want their gas prices hiked. Global leaders will turn a blind eye and Russia will increase its presence in Crimea. There won't be any sanctions.

Apart from the Ukraine, traders have ignored soft economic data. GDP, durable goods orders, initial claims and official PMI's came in light. ISM manufacturing was better than expected yesterday. In the next few days, bulls will be asked to ignore another weak round of data.

Without question, weather is impacting economic activity. Unfortunately, conditions will have to deteriorate significantly for tapering to be paused. Janet Yellen reiterated this last week during her Congressional testimony and her statements were consistent with the FOMC minutes. The safety net has been removed.

The resilience yesterday and the rebound today suggest a very strong bid.

I bought some puts yesterday and exited most of the position as I said I would before the close. I will evaluate the price action this morning. This relief rally could hit resistance so I will hang on as long as possible. My position is small so the damage will be contained.

I don't believe Asset Managers will chase stocks ahead of major economic releases.

As tempting as it is to jump back in, my instinct is to play it safe and to stay on the sidelines.

The Ukrainian crisis might not mean anything to the market, but the economic releases will. I will wait for the events to play out and then I will determine my game plan.

I will either hang on to my small put position today if we get a reversal and I will short on a day trading basis if we trade below SPY $186.30. If the market continues to rally I will take my lumps on my put position and I will be in cash ahead of the ADP report.

.

.

Daily Bulletin Continues...