Market Breakdown – More Selling Pressure Ahead – The 2nd Shoe Will Drop In May

When I don't get any comments, I question why I put hours into this free blog each day. Please CLICK HERE post a review on Investimonials.

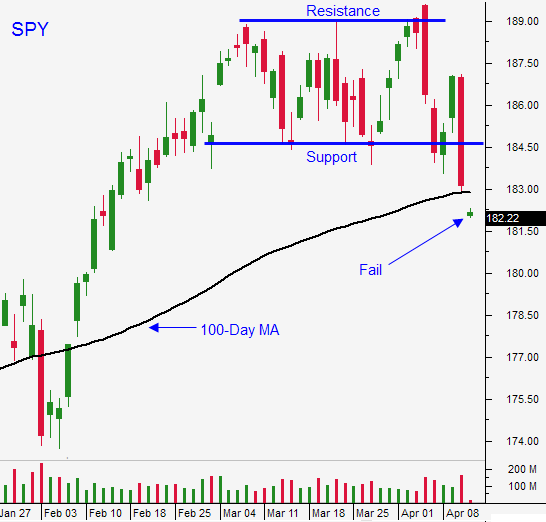

Posted 9:30 AM ET (Market Open) - During the last month my comments have had two themes: keep your size small in this low probability environment and prepare for a correction. Yesterday stocks broke support at SPY $184 and we quickly tested the 100-day moving average. The selling pressure is strong this morning and we will probe for support early in the day.

The decline seemed to come from nowhere. I posted my comments before the opening bell yesterday and they were spot on. The trade numbers from China were horrible and conditions continue to deteriorate. Their fiscal spending program will not bear fruit for many months. I also mentioned that the FOMC minutes did not reveal any information that would justify Wednesday's rally. Once the selling momentum started Thursday, Asset Managers sold stocks.

Only a week ago the market made a new all-time high after the jobs report. The number was soft and I did not understand the positive reaction. In my comments I mentioned that I would not participate in the rally. I wanted to see how far the market would run before profit-taking set in. I didn't have to wait long, the selling started right after the opening bell and we had a key reversal.

Most of you use my comments for the speculative portion of your portfolio. Realizing that, I thought it was important this week to address your longer-term investments. I've been encouraging you to reduce risk by selling stock or by buying puts as a hedge. I hope you took my advice because I see more danger ahead.

Wells Fargo and JP Morgan posted results this morning. WFC is treading water and JPM is down 4%. This is not a very encouraging sign for the financial sector. Retailers (BBBY, PIR and FDO) posted results and we did not see a "pop" and revenues. Analysts are expecting pent-up demand to be unleashed and we have yet to see signs of it.

There are many warning signs. Technically, the market has been slapped down every time it has tried to make a new high. That is a sign of exhaustion and Asset Managers are reducing risk. Bonds have rallied as the Fed reduces bond purchases and this suggests a flight to safety. Major support levels (100-day and 200-day moving averages) will be tested.

From a fundamental standpoint, the slowdown in China, emerging market credit concerns (Brazil, Argentina and Turkey), tapering, flat profits and lofty forward P/E's (16) present a problem.

Here is how I see this playing out.

This morning, stocks will probe for support early in the day. The move will get a little over-extended and we will rally back above the 100-day moving average. The bounce will lose its steam and sellers will return late in the day. No one wants to go home long. The market will continue to slide next week and we could go as low as the 200-Day MA (SPY $176) on an intraday basis.

Earning season will start to unfold and the "darlings" (GOOG, APPL, NFLX, FB, and TSLA) will post decent results. The market will snapback and it could challenge the 100-day moving average. Bullish speculators will jump back in expecting the same sling shot to new relative highs that we've seen the last couple of years. Unfortunately, the door will get slammed in their face this time.

Towards the end of April, the next wave of selling will begin. The 100-day moving average will fail and the 200-day moving average will be tested with ease. That support will fail if two conditions continue to exist.

1. China's growth continues to slip

2. US April job growth is below 250K

If there really is pent-up demand, that will stop the bleeding. I am a bit more certain abut China. I believe growth in Asia will continue to slide and fiscal spending programs won't reverse the trend.

If you have a lot of risk exposure, I urge you to lighten up.

I bought puts yesterday and I will look for opportunities to add this morning. Watch for a bounce and wait for it to run out of steam. That will provide an excellent entry point and we should see follow-through selling next week. Use SPY $184 as your stop.

.

.

Daily Bulletin Continues...