Play Golf or Catch a Good Movie – Dull Week of Trading Ahead. Sell a Few Put Spreads

Posted 9:45 AM ET - Go to the movies or to play a few rounds of golf. The market certainly won't provide excitement this week.

I wish I could tell you that the action will perk up next week, but it won't. Earnings season has almost ended and the jobs report is three weeks away (June 6). The next FOMC meeting is a month away (June 25).

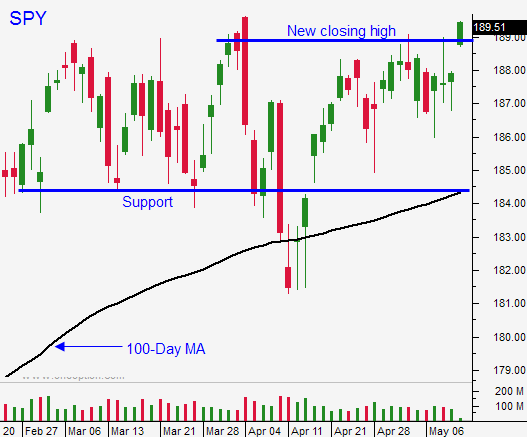

We are in a tight trading range and the SPY should stay between $186.50 and $188.50 this week. Trading volumes are light and they will decline ahead of the three-day weekend.

Until we see strong signs of pent-up demand or a sharp decline in China's economic activity, the market will continue to trade in a tight range. Interest rates are near historic lows and some money will trickle into equities due to a lack of attractive investment alternatives. However, if the market gets ahead of itself profit takers will step in. Stocks are not cheap at a forward P/E of 16.

The FOMC minutes will be released Wednesday. We already know that the Fed will continue to taper and they will leave room to pause if conditions deteriorate. I'm not expecting much of a reaction to the news release.

Flash PMI's will be posted Thursday. The results will show stable, but sluggish growth. This is the only noteworthy economic release this week and it could move the market. Any surprise favors the downside. Don't look for a sustained move ahead of the holiday.

The market attempted a breakout last week and the table was set for a short squeeze. The open interest for out of the money calls was relatively high ahead of option expiration. A small move could have forced sellers to buy back their calls and we had a chance for a nice run. Unfortunately, the market instantly pulled back into its trading range.

Look for opportunities to sell out of the money put credit spreads on stocks that have reported good earnings. Make sure there is a strong support level between the stock price and the short strike price. If the stock breaches support, buy the spread back. Keep your size small and distance yourself from the action. This strategy will help you take advantage of time decay.

Prepare for a boring week of trading.

.

.

Daily Bulletin Continues...