Expect Quiet Trading and Tight Ranges. No Spoilers Or Drivers This Week

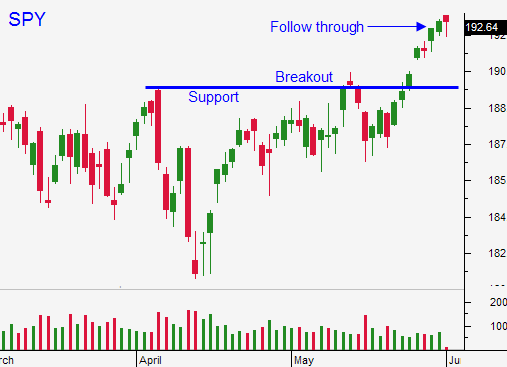

Posted 9:40 AM ET - The market broke out to a new all-time high a few weeks ago and it has not looked back. The volume has been very light and the level of conviction is low. We are in a news vacuum and we are headed for the summer doldrums.

Global economic activity remains sluggish. China's growth has been slipping for most of the year, but it has stabilized. GDP in the EU is expected to grow a meager 1% this year and Q1 GDP in the US fell by 1%.

Central banks are accommodative. Interest rates are near historic lows and money is creeping into equities due to a lack of attractive investment alternatives. With all of the quantitative easing, we can barely tread water.

The jobs report showed that 218,000 new jobs were created in May. That was in line with expectations, but it doesn't keep pace with the workforce. ADP was light and initial claims inched higher last week.

Corporate revenue growth is barely keeping pace with inflation and profit growth is flat. At a forward P/E of 16, stocks are not cheap.

Consumers are cautious and retailers were not very optimistic about Q2. The polar vortex was supposed to result in pent-up demand and we are not seeing it.

Asset Managers are not going to chase stocks at an all-time high when economic conditions are tenuous. They will wait for proof.

PIIGS bond yields are below US bond yields in some cases. This tells you that money is chasing yield and investors are getting pushed out on the risk curve. Translation: bubbles are forming.

Retirees who are focused on capital preservation are forced into equities because bond yields are miniscule. They can't generate enough income from bonds to cover their expenses. This is just another example of investors getting pushed out into riskier assets.

The path of least resistance is up and the news is light this week. I don't see any spoilers and I don't see drivers to push stocks higher.

I am day trading - no overnights. If we get a nice little pullback, I will sell out of the money put credit spreads on strong stocks.

Stay long, be small and use stops (SPY $194). Late day selling would be a sign of exhaustion and you should take profits on long positions if you see it.

Expect quiet trading and tight ranges.

.

.

Daily Bulletin Continues...