Lock In Profits On Call Positions. News Will Weigh On the Market Today

Posted 10:00 AM ET - Yesterday, the market pulled back as profit takers took some money off of the table. The damage was contained and the trading volumes remained very light.

This morning, initial jobless claims inched higher for the second week in a row. Retail sales missed and ex-auto, they increased 1%. That does not even keep pace with inflation and we are not seeing signs of pent-up demand.

China will post its retail sales and IP tonight. Conditions have stabilized, but any surprise favors the downside.

Flash PMI's won't be released until June 23rd and the action will be light next week. The momentum has stalled and we are likely to drift into the summer doldrums. Quad witching will add a little volatility.

Bond yields are at historic lows and some money is dripping into equities due to a lack of investment alternatives. Asset Managers are not going to chase stocks at an all-time high when economic conditions are tenuous. The S&P 500 is trading at a forward P/E of 16 and there is room for a pullback.

Corporate revenue growth is barely keeping pace with inflation and profits are flat. Q2 guidance has been cautious.

Eric Cantor, Iraq, initial claims and retail sales will weigh on the market today. I suggest taking profits on call positions.

I will day trade from the short side. If this turns out to be a decent pullback, I will sell some out of the money put credit spreads when support is established.

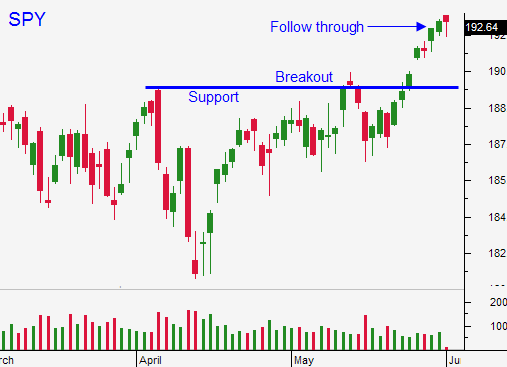

If bullish speculators get flushed out, we could test the breakout at SPY $190. I expect that level to hold.

Lock in profits on call positions.

.

.

Daily Bulletin Continues...