ADP Blows Away Estimates – Job Growth Will Fuel This Rally

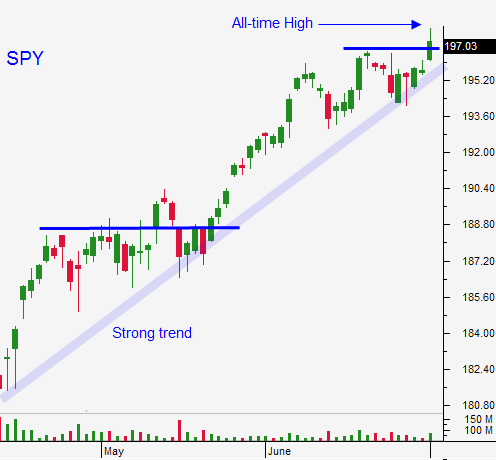

Yesterday, the market broke out to a new all-time high. This light volume rally continues to push higher and there is nothing to stand in the way.

Official PMI's were slightly better-than-expected and ISM Manufacturing was in line. New car sales were much better than expected and that sparked the rally Tuesday.

This morning, ADP reported 281,000 new jobs in the private sector during the month of June. That was much better than expected (200,000) and it bodes well for tomorrow's jobs report.

The market has rallied ahead of the Unemployment Report the last four months and that pattern is repeating itself. Q3 started off on a strong note and Asset Managers are bought equities. Earnings season kicks off next week and that also has bullish influence.

Recent earnings releases (Adobe, Intel, FedEx and Micron) have been good. Corporate profits were flat in Q1 and revenues barely kept pace with inflation. At a forward P/E of 16.5, good news is priced in.

Global economic conditions are stable, but sluggish. If economic growth gains traction, corporate revenues will expand. Companies are lean and mean and any top line growth will go right to the bottom.

Today's ADP report could be the sign we've been looking for. They process payrolls for small and medium-size businesses and I trust their number more than I do the Bureau of Labor Statistics.

Corporate guidance will be critical. They will feel demand accelerate and positive forecasts could fuel this rally.

I suggested buying calls yesterday and to use SPY $195.60 as your stop. Move your stop up to SPY $196. As the market continues to rally, raise your safety net.

Be safe as you celebrate the birth of the world's greatest nation.

Happy Fourth of July!

.

.

Daily Bulletin Continues...