Economic Recovery Might Be Underway – Earnings Season Starts Tues – Buy A Few Calls

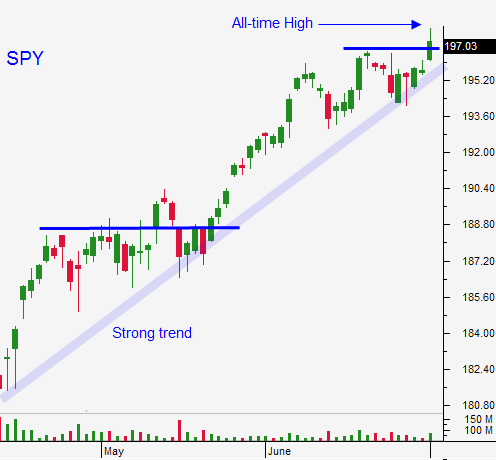

Posted - 11:15 AM ET - Last week, we get an excellent round of economic releases. The market established a new all-time high and traders are preparing for earnings season.

Chicago PMI, official global PMI's, ISM manufacturing, ISM services, ADP and the Unemployment Report were strong. Additionally, auto sales eclipsed 17 million for the first time since 2006.

It appears that an economic recovery is underway. Trading volumes have been very light and the level of conviction is low. Many Asset Managers have not fully participated in this rally and they are waiting for a pullback. That means we might not get one. As stocks continue to push higher, they will be playing catch-up.

Earnings season kicks off tomorrow, but the major announcements won't start for another week. Banks dominate the early scene and even if the news is mediocre, the stocks should rally. Higher interest rates are good for the financial sector. The strongest companies announce early in the earnings cycle and optimism will build.

At a forward P/E of 16.5, stocks are not cheap. However, corporations are lean and mean and any uptick in demand will go straight to the bottom line. If the economy is recovering, profits will grow quickly and P/Es will decline. Guidance for Q3 will be critical.

Interest rates will start to move higher. Even without economic growth, the Fed planned to taper. Quantitative easing has not stimulated economic growth and they know they need to take off the training wheels. The Fed has also hinted that they will introduce new tightening measures before tapering has ended. We might hear more about that during the next FOMC meeting.

The market won't like higher rates initially. However, as long as economic growth is on track, the market will embrace rising yields.

China will post retail sales and industrial production tonight. Their economic numbers have been good the last two months and fiscal spending seems to be bearing fruit. The numbers should be good. I believe stable growth in China is critical to this rally.

Trading volumes will be low this week after a holiday weekend. The economic news is also fairly light.

I bought a few calls last Wednesday and I added to the position on Thursday. I am looking for opportunities to buy more calls this week, but I am not loading up. To this point I have been day trading and I have been able to catch most of the moves.

Look for opportunities to buy calls this week. Use SPY $196 as your stop.

.

.

Daily Bulletin Continues...