Nervous Jitters Will Subside – Market Wants To Head Higher – Earnings Have Been Good

Posted 11:00 AM ET - Last Thursday, the market declined when the US and Europe imposed new economic sanctions against Russia. Hours later, a commercial jetliner was shot down by Ukrainian rebels and the situation deteriorated. There is little doubt that the weapons and training were provided by Putin and we can expect additional economic sanctions against Russia.

The bid to the market is strong and stocks rebounded Friday. If not for the political turmoil (Ukraine and Gaza), the market would be making new all-time highs.

Earning season has started off on a strong note. Profits are up almost 7% and revenues are up 3.5%. Healthcare got a boost from UNH and HMOs have been strong. Cyclicals benefited from Alcoa’s strong number and growth in China is back on track (7.5%). Banks prepared for bad news and the results were better than feared. The financial sector has been moving higher. Intel set the tone for tech and Google also made a nice move after earnings. We need tech to tread water after recent gains.

Apple and Microsoft will post results after the close Tuesday. This is going to be a very busy week for earnings. The recent jobs recovery should be confirmed in statements made by CEOs. Guidance for Q3 needs to be positive if the market is going to extend this rally.

Flash PMI's will be posted on Thursday. I am expecting good results in the US and in China – Europe will be soft.

The US and Europe will not put boots on the ground in the Ukraine. The rhetoric will escalate and we could see additional sanctions. Ultimately, nothing will change. Putin will continue to infiltrate the Ukraine and global markets won't care.

Earnings season should push the market to new highs in the next two weeks. The rally will hit resistance. August and September are weak months and the elections in November will start to weigh on the market. As economic conditions improve and global turmoil subsides, interest rates will start to move higher. The Fed plans to end tapering in October and traders will shift their focus to tightening.

The height of this rally will be set in the next few weeks.

We should still see bullish price action through July. There will be nervous jitters early in the week. When Asset Managers sense that the selling pressure has subsided, they will buy.

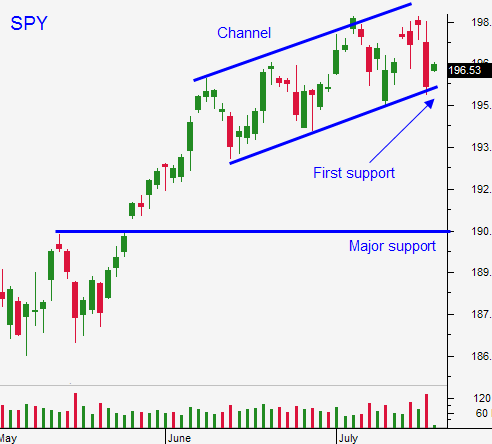

If you purchased calls last Friday, use SPY $196 as your stop. If you did not purchase calls, wait for the SPY to close above $197.

The early momentum favors the downside. If we make a new low after three hours of trading, we are likely to drift lower this afternoon.

.

.

Daily Bulletin Continues...