Market Still Has Some Upside – FOMC Wed – We Could See Jitters As October Approaches

Posted 9:00 AM ET - Yesterday the market made an all-time high after an excellent round of news. Unfortunately, the price action was sluggish and stocks looked a little tired. I am not expecting much of a retracement, but we could rest at this level for a few days.

Major economic releases will be posted next week (ADP, ISM manufacturing, ISM services, GDP and the Unemployment Report). Asset Managers will wait for the news before they continue their buying spree. This morning, durable goods orders exceeded estimates and it came in at .7%.

The level of participation was very light during the rally that started in May. Investors wanted proof that economic conditions are improving. Now that they have it, the bid has strengthened. That means dips will be brief and shallow.

Earnings season has been excellent with the bulk of companies having reported. Revenues are up about 3.5% and profits are up 7%. Mega cap tech companies (Intel, Microsoft, Apple, Google and Facebook) have performed well. Yesterday after the close, Amazon posted a loss. Revenue growth was strong, but they continue to invest in new ventures. The market is growing impatient and the stock traded lower after the report.

Cyclical stocks should be moving higher, but they look a bit strained. China posted a much better than expected flash PMI and Europe provided the biggest upside surprise. These stocks should gain traction in coming weeks.

Healthcare and financials also look strong. In a couple of weeks, retailers will post results. This sector has been beaten down and it is priced for bad news. Any surprise favors the upside.

Next week, the FOMC will release a statement (Wednesday). This usually sparks a market reaction. As October approaches (the end of tapering) the focus will shift to tightening. I don't believe we will hear about alternative tightening measures next week. The Fed will not meet again until September 16th and I don't believe they will cast a dark cloud over the financial markets when they are in recess. As a result, the statement might spook a few investors, but there will not be any material changes in policy.

Strong economic numbers next week will put upward pressure on interest rates. The market still has a few good weeks left in it, but the gains will be hard-fought. We could be entering a phase where good economic news is bad for the market.

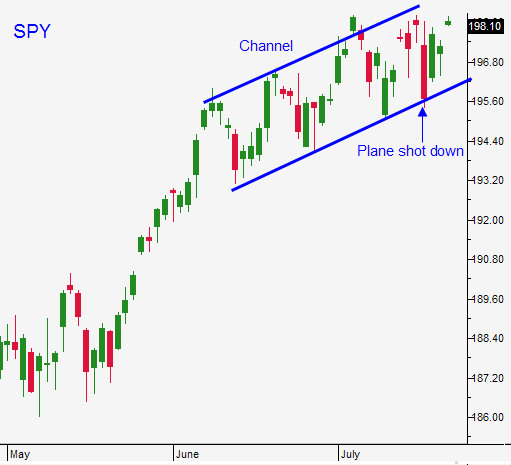

You should be long calls from a week ago - those positions are in great shape. Raise your stop to SPY $198.

I was prepared to buy more calls yesterday, but I didn't. The market could not follow through and the highs for the day were established in the first few minutes of trading. I don't feel compelled to buy more calls ahead of the weekend so I will keep my powder dry until Monday.

Look for soft price action this morning. The market is likely to fall into a tight trading range after the first hour.

Stay long and maintain stops.

.

.

Daily Bulletin Continues...