FOMC and Strong Economic Data Could Spark A Light Round of Selling. Buy the Dip

Posted 9:30 AM ET - Last week, the market got an excellent round of earnings releases. Mega cap tech stocks (Intel, Microsoft, Google, Apple and Facebook) produced great results and they moved higher. Unfortunately, the market was not able to advance.

I've been mentioning that the strongest companies announce early in the earnings cycle. Optimism builds quickly and the market tends to get a little overextended. I'm not looking for a big pullback, but the market needs time to gather strength.

The earnings calendar will be heavy this week, but the focus will shift to economic releases (ADP, ISM manufacturing, ISM services, GDP and the Unemployment Report) and the FOMC meeting. We are likely to see some nervous jitters.

Multiple sources confirm the job recovery. Initial claims have been excellent the last four weeks and that bodes well for Friday's number. Strong economic data will put upward pressure on interest rates.

The FOMC will post its statement on Wednesday and they will not meet again until September 16th. I don't believe their statement will outline alternative tightening measures. They don't want to spook the market when they are in recess.

Everyone knows that tapering will end in October. Once that timeline passes, the focus will immediately shift to tightening. Strong economic releases will prompt Bond Managers to start adjusting duration. Interest rates will start creeping higher.

Interest rates have been low for six years and when this trend starts to reverse, the market won't like it. We will go through a spell where "good news is bad news". Over time, the market will embrace higher interest rates if they are accompanied by strong economic growth and good earnings.

The Fed has never had a bigger balance sheet and it is impossible to predict how long this adjustment process will take. I believe that it is still too early for this week's news to have a major negative impact.

Asset Managers did not participate in the light volume rally that started in May. They were waiting for stronger economic data and now they have it. Many are playing catch-up and the bid to the market should remain strong. Any dip will present a buying opportunity.

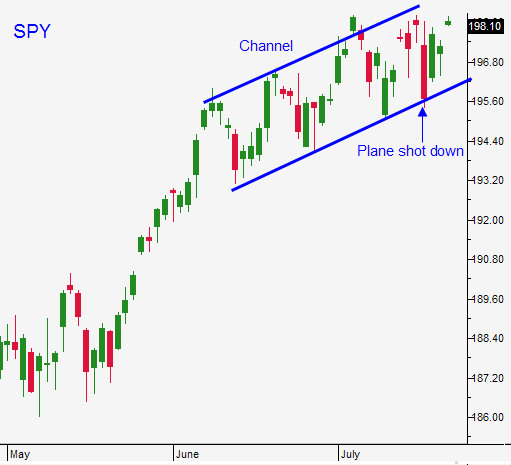

Last week I suggested raising your stop to SPY $198. I exited my call positions on Friday and I locked-in nice gains. I'm happy to be on the sidelines and I will evaluate the price action this week.

If the FOMC sparks a round of selling, I will be a call buyer at SPY $196. I want to see immediate support – I will keep a tight stop. On the chart you can see the upward sloping channel. That needs to be preserved in order for me to stay bullish.

Look for nervous jitters this week on strong economic releases. The earnings releases should be good, but good news is priced in.

Wait for a dip and buy on support.

.

.

Daily Bulletin Continues...